Authors

Summary

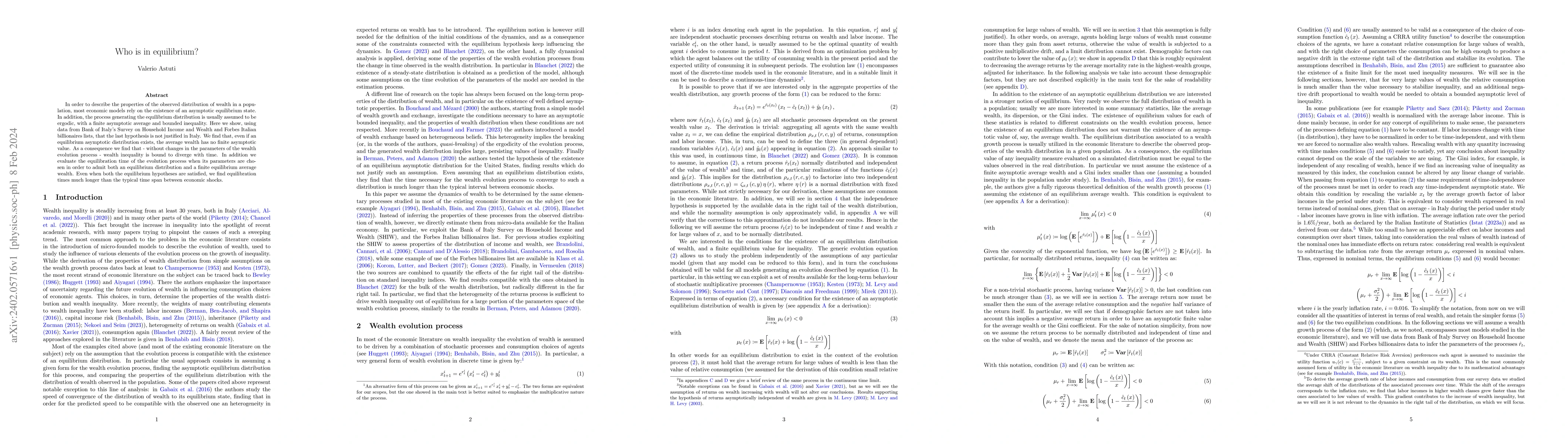

In order to describe the properties of the observed distribution of wealth in a population, most economic models rely on the existence of an asymptotic equilibrium state. In addition, the process generating the equilibrium distribution is usually assumed to be ergodic, with a finite asymptotic average and bounded inequality. Here we show, using data from Bank of Italy's Survey on Household Income and Wealth and Forbes Italian billionaires lists, that the last hypothesis is not justified in Italy. We find that, even if an equilibrium asymptotic distribution exists, the average wealth has no finite asymptotic value. As a consequence we find that - without changes in the parameters of the wealth evolution process - wealth inequality is bound to diverge with time. In addition we evaluate the equilibration time of the evolution process when its parameters are chosen in order to admit both an equilibrium distribution and a finite equilibrium average wealth. Even when both the equilibrium hypotheses are satisfied, we find equilibration times much longer than the typical time span between economic shocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)