Summary

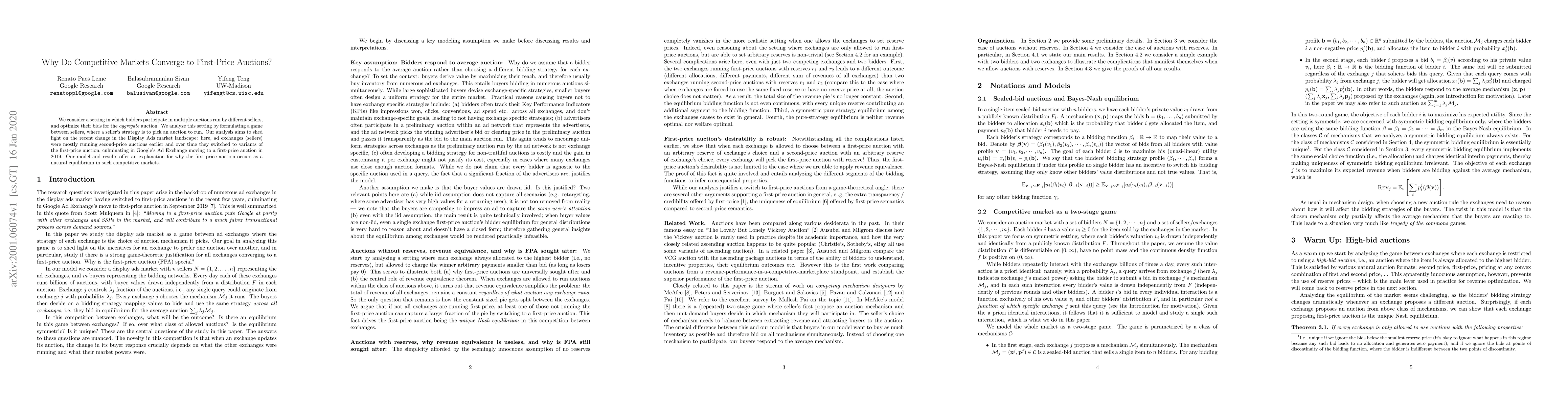

We consider a setting in which bidders participate in multiple auctions run by different sellers, and optimize their bids for the \emph{aggregate} auction. We analyze this setting by formulating a game between sellers, where a seller's strategy is to pick an auction to run. Our analysis aims to shed light on the recent change in the Display Ads market landscape: here, ad exchanges (sellers) were mostly running second-price auctions earlier and over time they switched to variants of the first-price auction, culminating in Google's Ad Exchange moving to a first-price auction in 2019. Our model and results offer an explanation for why the first-price auction occurs as a natural equilibrium in such competitive markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice Manipulability in First-Price Auctions

Paul Dütting, Balasubramanian Sivan, Johannes Brustle

Learning to Bid in Repeated First-Price Auctions with Budgets

Qian Wang, Xiaotie Deng, Yuqing Kong et al.

Learning to Bid in Non-Stationary Repeated First-Price Auctions

Yuan Yao, Jiheng Zhang, Zhengyuan Zhou et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)