Summary

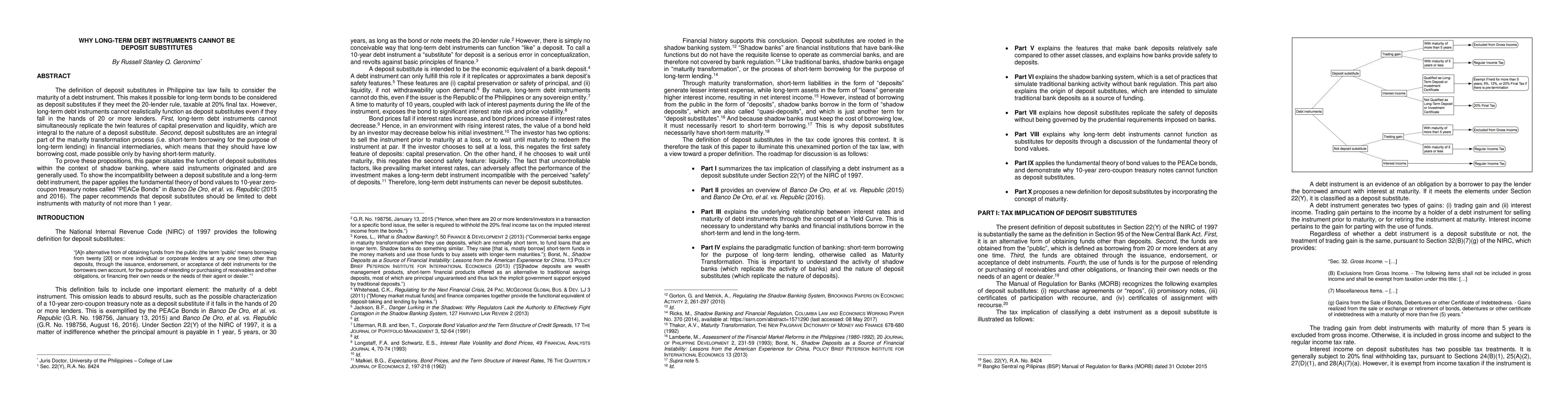

The definition of deposit substitutes in Philippine tax law fails to consider the maturity of a debt instrument. This makes it possible for long-term bonds to be considered as deposit substitutes if they meet the 20-lender rule, taxable at 20% final tax. However, long-term debt instruments cannot realistically function as deposit substitutes even if they fall in the hands of 20 or more lenders. First, long-term debt instruments cannot simultaneously replicate the twin features of capital preservation and liquidity, which are integral to the nature of a deposit substitute. Second, deposit substitutes are an integral part of the maturity transformation process (i.e. short-term borrowing for the purpose of long-term lending) in financial intermediaries, which means that they should have low borrowing cost, made possible only by having short-term maturity. To prove these propositions, this paper situates the function of deposit substitutes within the context of shadow banking, where said instruments originated and are generally used. To show the incompatibility between a deposit substitute and a long-term debt instrument, the paper applies the fundamental theory of bond values to 10-year zero-coupon treasury notes called 'PEACe Bonds' in Banco De Oro, et al. vs. Republic (2015 and 2016). The paper recommends that deposit substitutes should be limited to debt instruments with maturity of not more than 1 year.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)