Summary

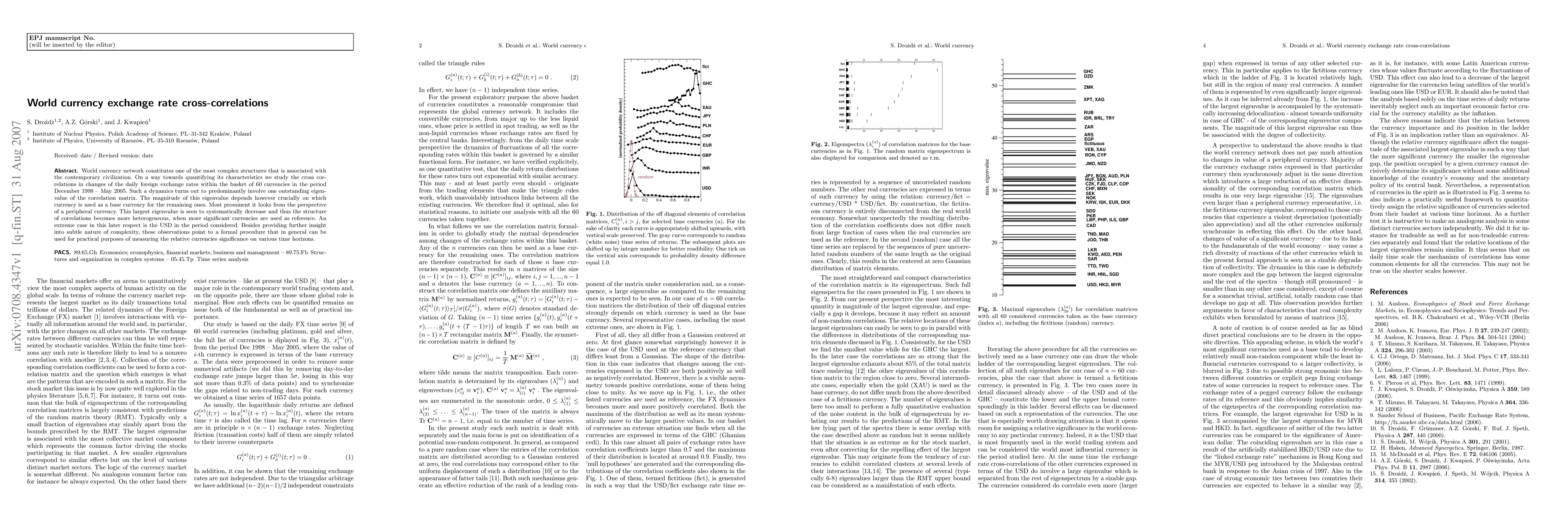

World currency network constitutes one of the most complex structures that is associated with the contemporary civilization. On a way towards quantifying its characteristics we study the cross correlations in changes of the daily foreign exchange rates within the basket of 60 currencies in the period December 1998 -- May 2005. Such a dynamics turns out to predominantly involve one outstanding eigenvalue of the correlation matrix. The magnitude of this eigenvalue depends however crucially on which currency is used as a base currency for the remaining ones. Most prominent it looks from the perspective of a peripheral currency. This largest eigenvalue is seen to systematically decrease and thus the structure of correlations becomes more heterogeneous, when more significant currencies are used as reference. An extreme case in this later respect is the USD in the period considered. Besides providing further insight into subtle nature of complexity, these observations point to a formal procedure that in general can be used for practical purposes of measuring the relative currencies significance on various time horizons.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)