Summary

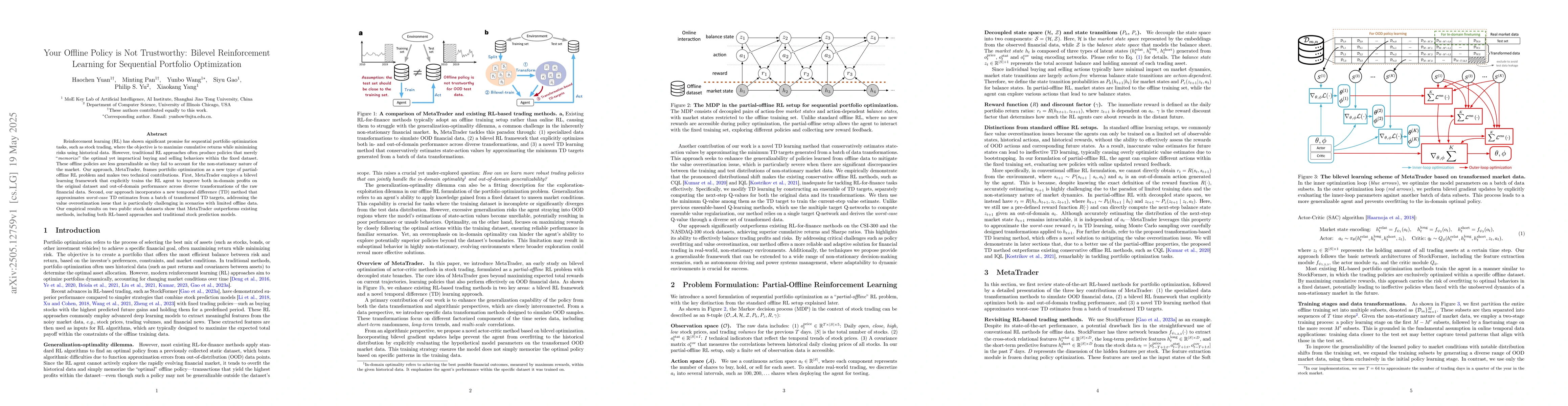

Reinforcement learning (RL) has shown significant promise for sequential portfolio optimization tasks, such as stock trading, where the objective is to maximize cumulative returns while minimizing risks using historical data. However, traditional RL approaches often produce policies that merely memorize the optimal yet impractical buying and selling behaviors within the fixed dataset. These offline policies are less generalizable as they fail to account for the non-stationary nature of the market. Our approach, MetaTrader, frames portfolio optimization as a new type of partial-offline RL problem and makes two technical contributions. First, MetaTrader employs a bilevel learning framework that explicitly trains the RL agent to improve both in-domain profits on the original dataset and out-of-domain performance across diverse transformations of the raw financial data. Second, our approach incorporates a new temporal difference (TD) method that approximates worst-case TD estimates from a batch of transformed TD targets, addressing the value overestimation issue that is particularly challenging in scenarios with limited offline data. Our empirical results on two public stock datasets show that MetaTrader outperforms existing methods, including both RL-based approaches and traditional stock prediction models.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper introduces MetaTrader, a bilevel reinforcement learning framework for sequential portfolio optimization tasks, addressing the issue of offline policies memorizing impractical behaviors in traditional RL approaches.

Key Results

- MetaTrader outperforms existing RL-based methods and traditional stock prediction models on two public stock datasets.

- The bilevel learning framework improves both in-domain profits on the original dataset and out-of-domain performance across diverse financial data transformations.

Significance

This research is significant as it tackles the non-stationary nature of the market and the value overestimation issue in scenarios with limited offline data, providing a more generalizable solution for stock trading and similar sequential portfolio optimization tasks.

Technical Contribution

The main technical contribution is the bilevel learning framework and a novel temporal difference (TD) method that approximates worst-case TD estimates from a batch of transformed TD targets.

Novelty

MetaTrader distinguishes itself by framing portfolio optimization as a partial-offline RL problem and explicitly training the RL agent to balance in-domain and out-of-domain performance, which is not addressed in existing RL-based approaches.

Limitations

- The paper does not discuss potential limitations or challenges in applying MetaTrader to real-world trading scenarios.

- No information is provided on computational resources or scalability of the proposed method.

Future Work

- Investigate the applicability of MetaTrader to other non-stationary sequential decision-making tasks.

- Explore methods to address computational complexity and scalability for larger datasets and more complex financial markets.

Paper Details

PDF Preview

Similar Papers

Found 4 papersOffline Multi-Agent Reinforcement Learning via In-Sample Sequential Policy Optimization

Chao Yu, Yile Liang, Donghui Li et al.

Supported Policy Optimization for Offline Reinforcement Learning

Zihan Qiu, Haixu Wu, Mingsheng Long et al.

Adversarial Policy Optimization for Offline Preference-based Reinforcement Learning

Min-hwan Oh, Hyungkyu Kang

Analytic Energy-Guided Policy Optimization for Offline Reinforcement Learning

Lichao Sun, Dacheng Tao, Li Shen et al.

No citations found for this paper.

Comments (0)