Authors

Summary

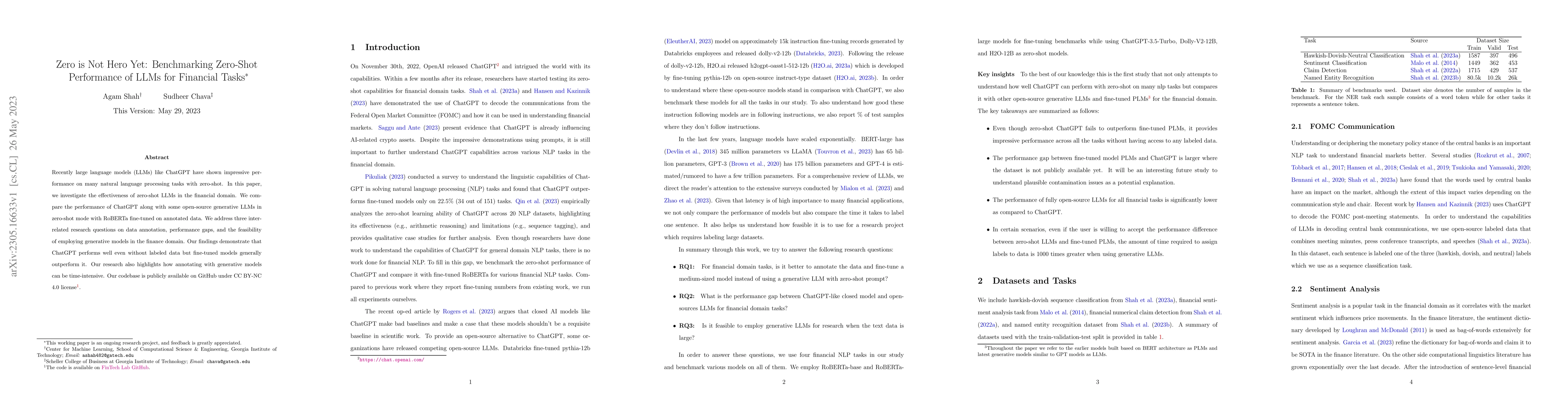

Recently large language models (LLMs) like ChatGPT have shown impressive performance on many natural language processing tasks with zero-shot. In this paper, we investigate the effectiveness of zero-shot LLMs in the financial domain. We compare the performance of ChatGPT along with some open-source generative LLMs in zero-shot mode with RoBERTa fine-tuned on annotated data. We address three inter-related research questions on data annotation, performance gaps, and the feasibility of employing generative models in the finance domain. Our findings demonstrate that ChatGPT performs well even without labeled data but fine-tuned models generally outperform it. Our research also highlights how annotating with generative models can be time-intensive. Our codebase is publicly available on GitHub under CC BY-NC 4.0 license.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBetter Benchmarking LLMs for Zero-Shot Dependency Parsing

Carlos Gómez-Rodríguez, David Vilares, Ana Ezquerro

Benchmarking Foundation Models for Zero-Shot Biometric Tasks

Parisa Farmanifard, Arun Ross, Nitish Shukla et al.

Zero-to-Hero: Zero-Shot Initialization Empowering Reference-Based Video Appearance Editing

Jun Huang, Chengyu Wang, Tongtong Su et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)