Summary

In this paper we consider two-person zero-sum risk-sensitive stochastic dynamic games with Borel state and action spaces and bounded reward. The term risk-sensitive refers to the fact that instead of the usual risk neutral optimization criterion we consider the exponential certainty equivalent. The discounted reward case on a finite and an infinite time horizon is considered, as well as the ergodic reward case. Under continuity and compactness conditions we prove that the value of the game exists and solves the Shapley equation and we show the existence of optimal (non-stationary) strategies. In the ergodic reward case we work with a local minorization property and a Lyapunov condition and show that the value of the game solves the Poisson equation. Moreover, we prove the existence of optimal stationary strategies. A simple example highlights the influence of the risk-sensitivity parameter. Our results generalize findings in Basu/Ghosh 2014 and answer an open question posed there.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

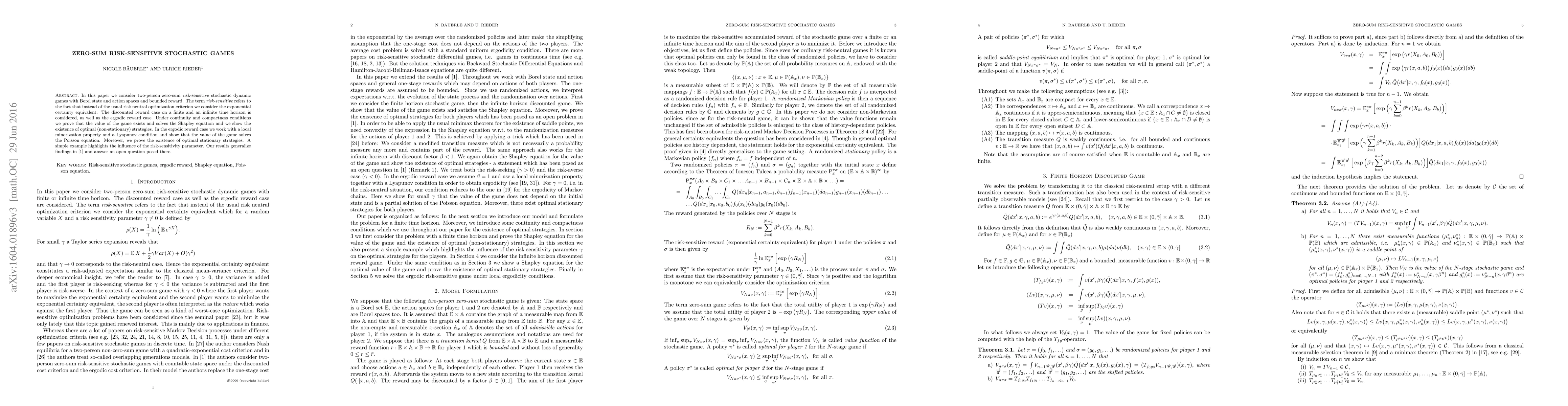

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAlgorithms for zero-sum stochastic games with the risk-sensitive average criterion

Xin Guo, Fang Chen, Junyu Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)