Authors

Summary

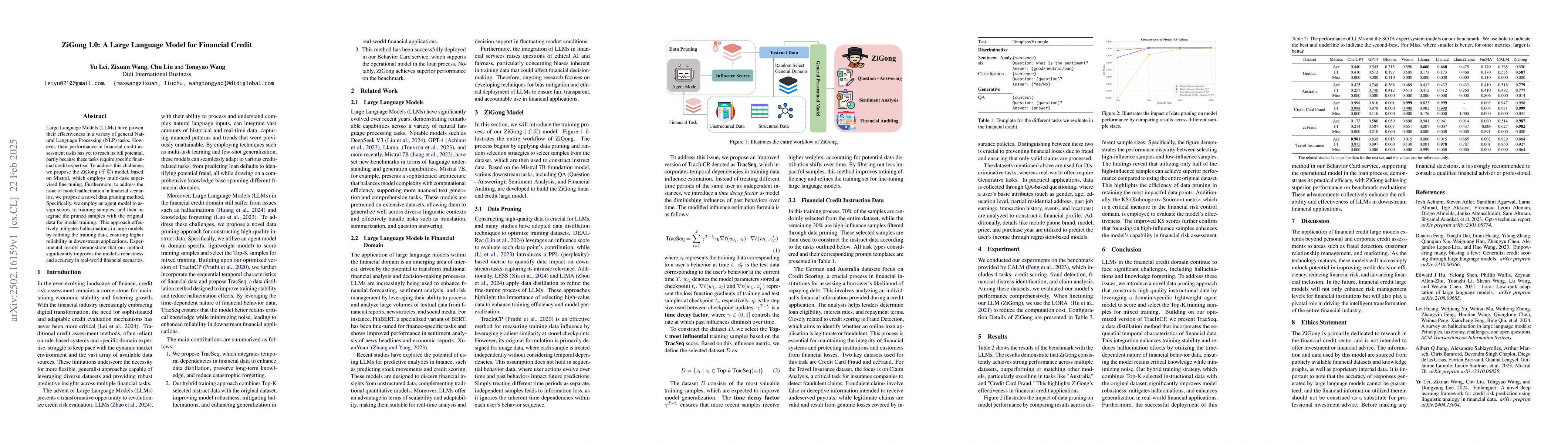

Large Language Models (LLMs) have demonstrated strong performance across various general Natural Language Processing (NLP) tasks. However, their effectiveness in financial credit assessment applications remains suboptimal, primarily due to the specialized financial expertise required for these tasks. To address this limitation, we propose ZiGong, a Mistral-based model enhanced through multi-task supervised fine-tuning. To specifically combat model hallucination in financial contexts, we introduce a novel data pruning methodology. Our approach utilizes a proxy model to score training samples, subsequently combining filtered data with original datasets for model training. This data refinement strategy effectively reduces hallucinations in LLMs while maintaining reliability in downstream financial applications. Experimental results show our method significantly enhances model robustness and prediction accuracy in real-world financial scenarios.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research proposes ZiGong, a Mistral-based LLM enhanced via multi-task supervised fine-tuning for financial credit assessment. A novel data pruning methodology is introduced, using a proxy model to score training samples and combining filtered data with original datasets for model training.

Key Results

- ZiGong significantly enhances model robustness and prediction accuracy in real-world financial scenarios.

- Experimental results demonstrate superior performance of ZiGong on benchmark datasets, especially in tasks like 'Australia' and 'CreditCardFraud'.

- Data pruning methodology effectively reduces hallucinations in LLMs while maintaining reliability in downstream financial applications.

Significance

This research is important as it addresses the suboptimal effectiveness of LLMs in financial credit assessment tasks by introducing a specialized model tailored for financial data, which can improve credit scoring, fraud detection, financial distress identification, and claim analysis.

Technical Contribution

The main technical contribution is the introduction of ZiGong, a fine-tuned Mistral model with an improved data pruning methodology (TracSeq) that incorporates temporal dependencies in financial data, enhancing training stability and reducing hallucination effects.

Novelty

The novelty of this work lies in the development of ZiGong, a specialized LLM for financial credit assessment, and the TracSeq data pruning method, which effectively leverages the sequential nature of financial data to improve model performance and reliability.

Limitations

- The paper does not explicitly discuss limitations of the proposed method.

- Generalizability of ZiGong to other financial domains beyond those tested in the experiments is not addressed.

Future Work

- Explore the applicability of ZiGong in other financial domains such as investment analysis or risk management.

- Investigate methods to further reduce computational costs and improve efficiency in fine-tuning large language models for financial tasks.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Dutch Financial Large Language Model

Tijl De Bie, Sander Noels, Jorne De Blaere

Empowering Many, Biasing a Few: Generalist Credit Scoring through Large Language Models

Duanyu Feng, Yongfu Dai, Zhengyu Chen et al.

Large Language Model Adaptation for Financial Sentiment Analysis

Pau Rodriguez Inserte, Mariam Nakhlé, Raheel Qader et al.

No citations found for this paper.

Comments (0)