Achintya Gopal

12 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

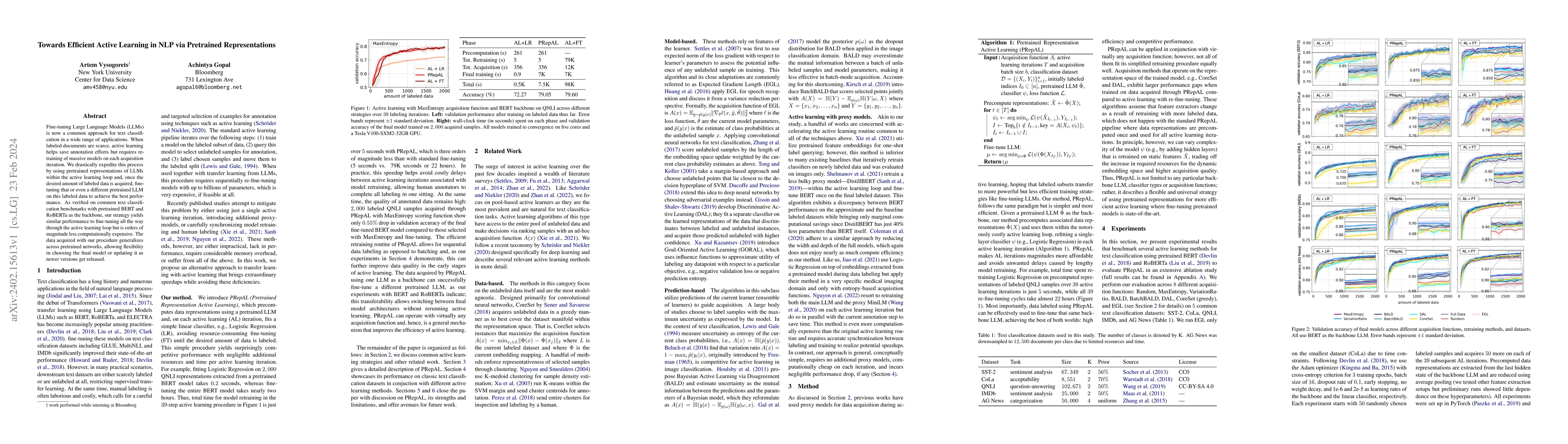

Towards Efficient Active Learning in NLP via Pretrained Representations

Fine-tuning Large Language Models (LLMs) is now a common approach for text classification in a wide range of applications. When labeled documents are scarce, active learning helps save annotation ef...

Causal Discovery in Financial Markets: A Framework for Nonstationary Time-Series Data

This paper introduces a new causal structure learning method for nonstationary time series data, a common data type found in fields such as finance, economics, healthcare, and environmental science....

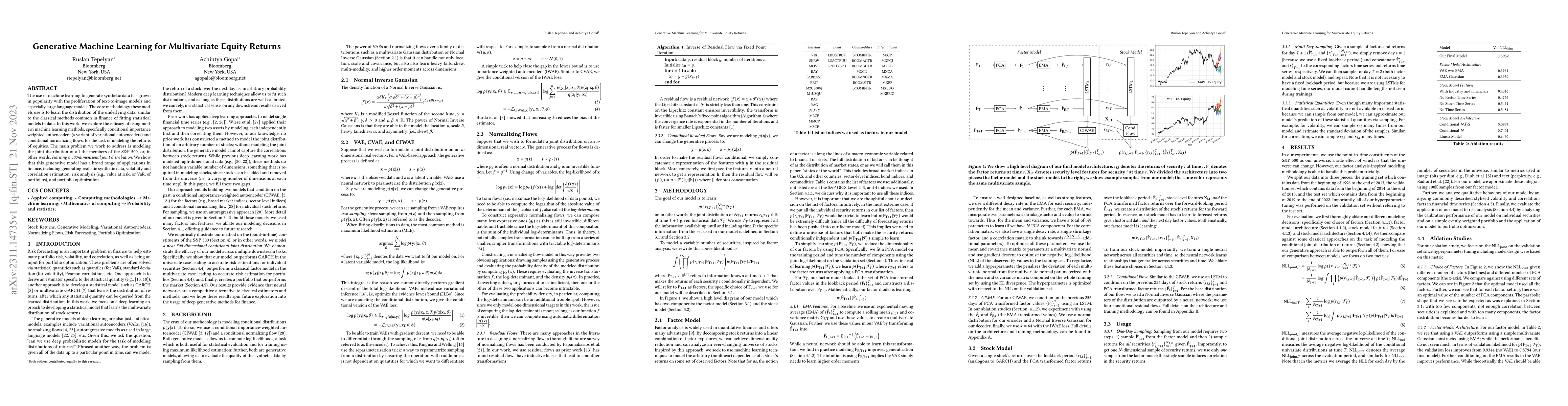

Generative Machine Learning for Multivariate Equity Returns

The use of machine learning to generate synthetic data has grown in popularity with the proliferation of text-to-image models and especially large language models. The core methodology these models ...

DP-TBART: A Transformer-based Autoregressive Model for Differentially Private Tabular Data Generation

The generation of synthetic tabular data that preserves differential privacy is a problem of growing importance. While traditional marginal-based methods have achieved impressive results, recent wor...

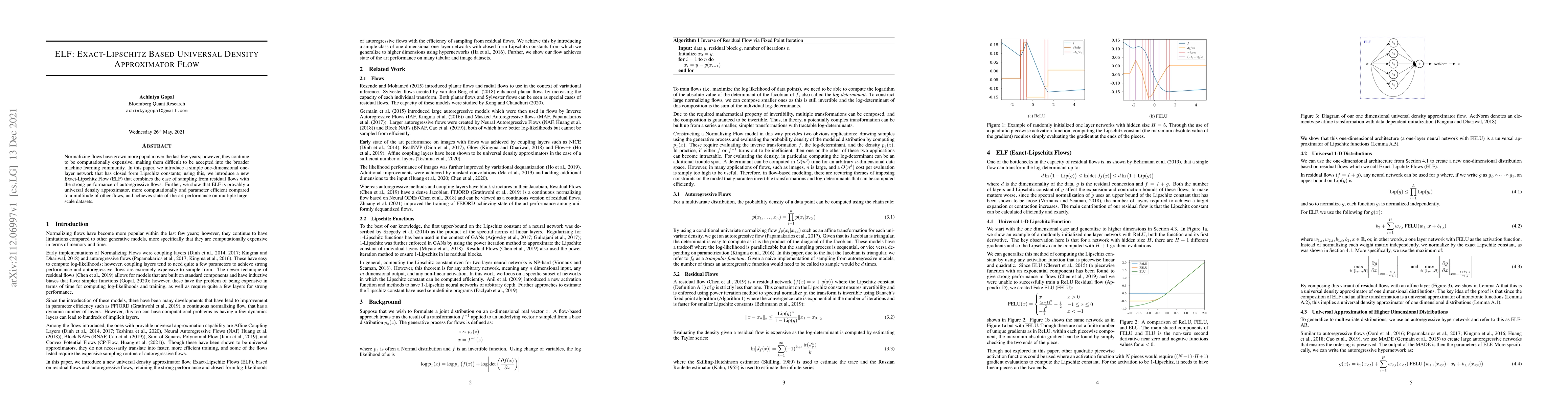

ELF: Exact-Lipschitz Based Universal Density Approximator Flow

Normalizing flows have grown more popular over the last few years; however, they continue to be computationally expensive, making them difficult to be accepted into the broader machine learning comm...

Why Calibration Error is Wrong Given Model Uncertainty: Using Posterior Predictive Checks with Deep Learning

Within the last few years, there has been a move towards using statistical models in conjunction with neural networks with the end goal of being able to better answer the question, "what do our mode...

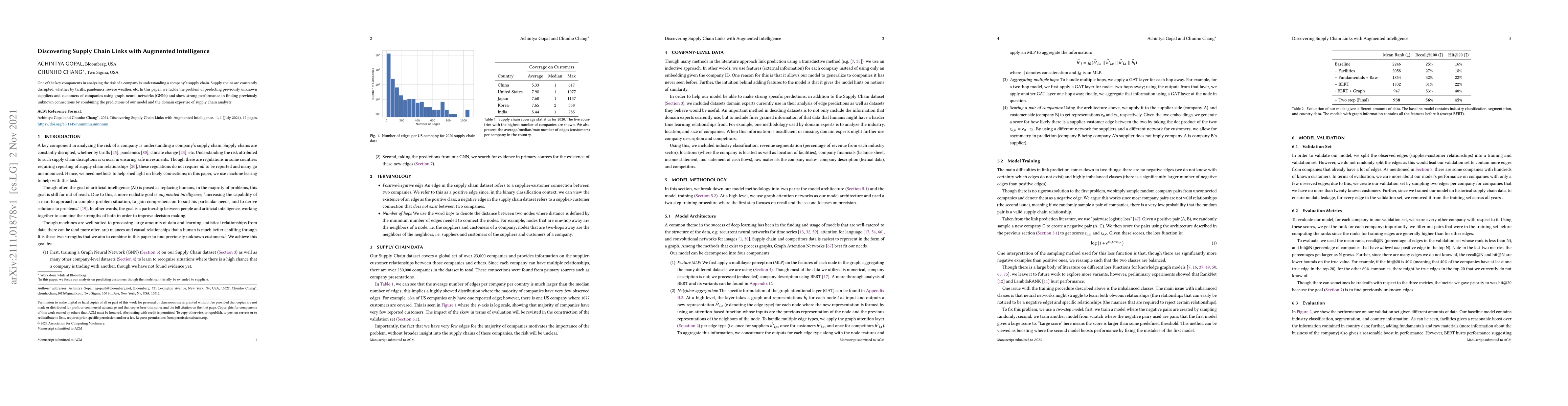

Discovering Supply Chain Links with Augmented Intelligence

One of the key components in analyzing the risk of a company is understanding a company's supply chain. Supply chains are constantly disrupted, whether by tariffs, pandemics, severe weather, etc. In...

NeuralBeta: Estimating Beta Using Deep Learning

Traditional approaches to estimating beta in finance often involve rigid assumptions and fail to adequately capture beta dynamics, limiting their effectiveness in use cases like hedging. To address th...

NeuralFactors: A Novel Factor Learning Approach to Generative Modeling of Equities

The use of machine learning for statistical modeling (and thus, generative modeling) has grown in popularity with the proliferation of time series models, text-to-image models, and especially large la...

Filling in Missing FX Implied Volatilities with Uncertainties: Improving VAE-Based Volatility Imputation

Missing data is a common problem in finance and often requires methods to fill in the gaps, or in other words, imputation. In this work, we focused on the imputation of missing implied volatilities fo...

DELPHYNE: A Pre-Trained Model for General and Financial Time Series

Time-series data is a vital modality within data science communities. This is particularly valuable in financial applications, where it helps in detecting patterns, understanding market behavior, and ...

Efficient Causal Discovery for Autoregressive Time Series

In this study, we present a novel constraint-based algorithm for causal structure learning specifically designed for nonlinear autoregressive time series. Our algorithm significantly reduces computati...