Authors

Summary

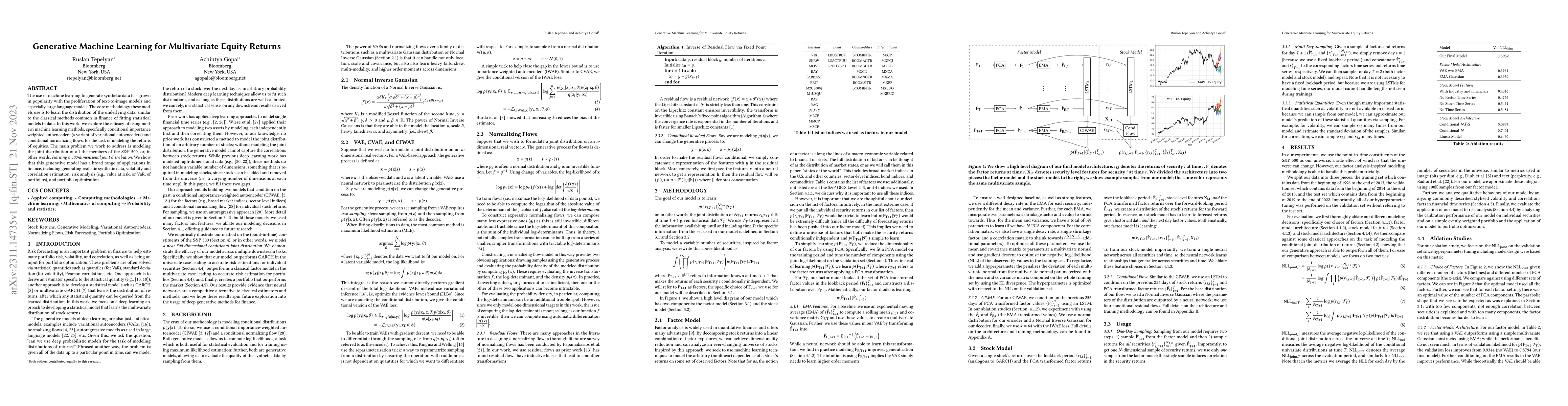

The use of machine learning to generate synthetic data has grown in popularity with the proliferation of text-to-image models and especially large language models. The core methodology these models use is to learn the distribution of the underlying data, similar to the classical methods common in finance of fitting statistical models to data. In this work, we explore the efficacy of using modern machine learning methods, specifically conditional importance weighted autoencoders (a variant of variational autoencoders) and conditional normalizing flows, for the task of modeling the returns of equities. The main problem we work to address is modeling the joint distribution of all the members of the S&P 500, or, in other words, learning a 500-dimensional joint distribution. We show that this generative model has a broad range of applications in finance, including generating realistic synthetic data, volatility and correlation estimation, risk analysis (e.g., value at risk, or VaR, of portfolios), and portfolio optimization.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper employs conditional Importance Weighted Autoencoders (CIWAE) and Conditional Normalizing Flows to model the joint distribution of S&P 500 equity returns, extending factor analysis using machine learning methods.

Key Results

- The proposed generative models outperform GARCH and classical factor models in terms of negative log-likelihood (NLLjoint) and Sharpe ratio for portfolio optimization.

- The models accurately capture stylized facts such as volatility clustering and leverage effect, surpassing GARCH and classical factor models in these aspects.

- The study demonstrates that training on a large number of stocks, even when only interested in a few, improves performance on individual stocks or portfolios.

- The models provide well-calibrated distribution estimates, enabling better risk analysis and portfolio optimization.

- The paper shows that the models can generate realistic synthetic data, which is useful for forward-looking prediction problems.

Significance

This research extends factor analysis into a more general approach using machine learning, demonstrating the potential of ML-based distributional modeling in finance and showcasing the successful application of synthetic data.

Technical Contribution

The paper introduces a novel approach for modeling multivariate equity returns using conditional generative models, specifically CIWAE and Conditional Normalizing Flows, which outperform traditional GARCH and factor models.

Novelty

The research extends the concept of factor analysis using modern machine learning techniques, demonstrating the effectiveness of generative models in capturing the joint distribution of equity returns and their applications in finance.

Limitations

- The study does not extensively explore the impact of varying lookback periods on model performance.

- Limited analysis of the models' behavior under different economic conditions or market regimes.

Future Work

- Investigate the performance of the models under varying lookback periods and economic conditions.

- Explore the use of additional architectures (e.g., attention mechanisms) and features (e.g., news) for the underlying ML models.

- Perform a deeper analysis of volatility and correlation estimation with larger universes of stocks.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGenerative machine learning methods for multivariate ensemble post-processing

Sebastian Lerch, Florian Steinke, Jieyu Chen et al.

Dissecting the explanatory power of ESG features on equity returns by sector, capitalization, and year with interpretable machine learning

Laurent Carlier, Damien Challet, Jérémi Assael

Isotropic Correlation Models for the Cross-Section of Equity Returns

Graham L. Giller

| Title | Authors | Year | Actions |

|---|

Comments (0)