Andrea Pallavicini

7 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

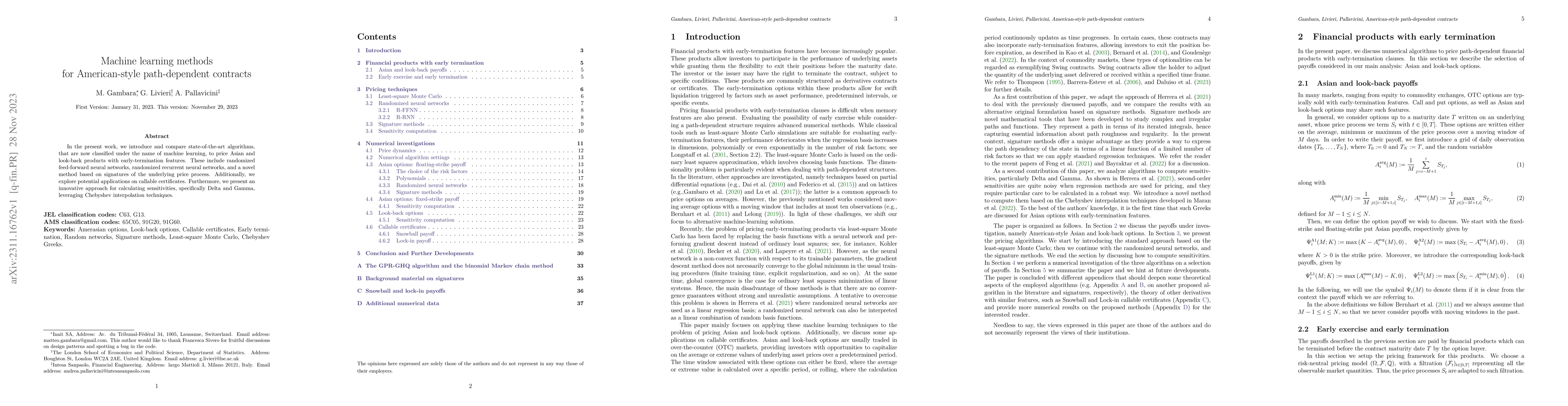

Machine learning methods for American-style path-dependent contracts

In the present work, we introduce and compare state-of-the-art algorithms, that are now classified under the name of machine learning, to price Asian and look-back products with early-termination fe...

Pricing commodity index options

We present a stochastic local volatility model for derivative contracts on commodity futures. The aim of the model is to be able to recover the prices of derivative claims both on futures contracts ...

Rough-Heston Local-Volatility Model

In industrial applications it is quite common to use stochastic volatility models driven by semi-martingale Markov volatility processes. However, in order to fit exactly market volatilities, these m...

Reinforcement learning for options on target volatility funds

In this work we deal with the funding costs rising from hedging the risky securities underlying a target volatility strategy (TVS), a portfolio of risky assets and a risk-free one dynamically rebala...

Interpolating commodity futures prices with Kriging

The shape of the futures term structure is essential to commodity hedgers and speculators as futures prices serve as a forecast of future spot prices. Commodity markets quotes futures prices on a se...

Evaluating Microscopic and Macroscopic Models for Derivative Contracts on Commodity Indices

In this article, we analyze two modeling approaches for the pricing of derivative contracts on a commodity index. The first one is a microscopic approach, where the components of the index are modeled...

Pricing Quanto and Composite Contracts with Local-Correlation Models

Pricing composite and quanto contracts requires a joint model of both the underlying asset and the exchange rate. In this contribution, we explore the potential of local-correlation models to address ...