Summary

In the present work, we introduce and compare state-of-the-art algorithms, that are now classified under the name of machine learning, to price Asian and look-back products with early-termination features. These include randomized feed-forward neural networks, randomized recurrent neural networks, and a novel method based on signatures of the underlying price process. Additionally, we explore potential applications on callable certificates. Furthermore, we present an innovative approach for calculating sensitivities, specifically Delta and Gamma, leveraging Chebyshev interpolation techniques.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

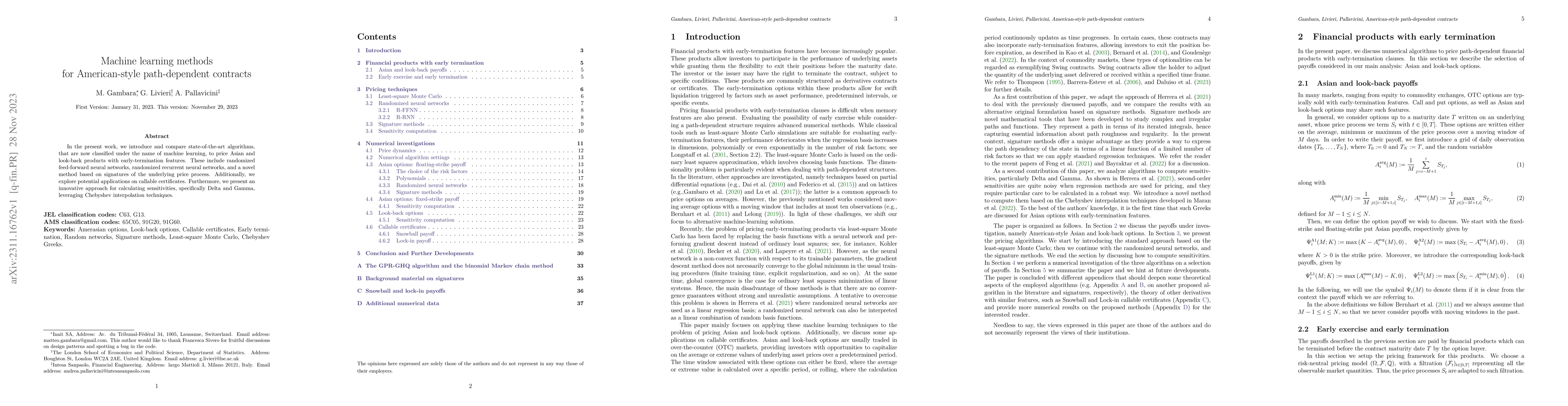

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPricing American Options using Machine Learning Algorithms

Prudence Djagba, Callixte Ndizihiwe

A note on the numerical approximation of Greeks for American-style options

Karel J. in 't Hout

| Title | Authors | Year | Actions |

|---|

Comments (0)