Authors

Summary

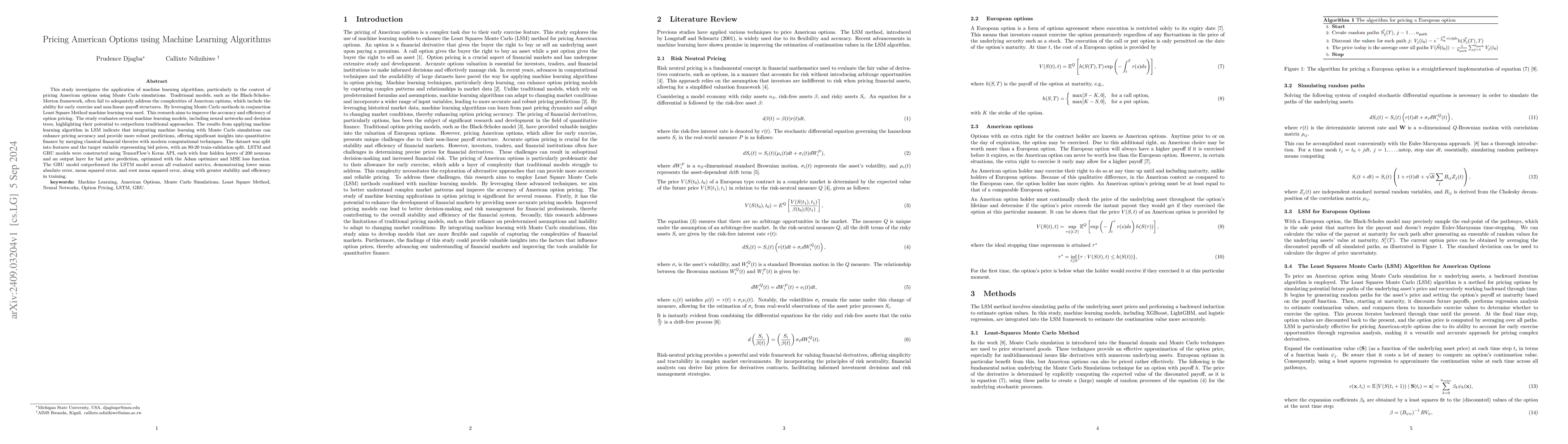

This study investigates the application of machine learning algorithms, particularly in the context of pricing American options using Monte Carlo simulations. Traditional models, such as the Black-Scholes-Merton framework, often fail to adequately address the complexities of American options, which include the ability for early exercise and non-linear payoff structures. By leveraging Monte Carlo methods in conjunction Least Square Method machine learning was used. This research aims to improve the accuracy and efficiency of option pricing. The study evaluates several machine learning models, including neural networks and decision trees, highlighting their potential to outperform traditional approaches. The results from applying machine learning algorithm in LSM indicate that integrating machine learning with Monte Carlo simulations can enhance pricing accuracy and provide more robust predictions, offering significant insights into quantitative finance by merging classical financial theories with modern computational techniques. The dataset was split into features and the target variable representing bid prices, with an 80-20 train-validation split. LSTM and GRU models were constructed using TensorFlow's Keras API, each with four hidden layers of 200 neurons and an output layer for bid price prediction, optimized with the Adam optimizer and MSE loss function. The GRU model outperformed the LSTM model across all evaluated metrics, demonstrating lower mean absolute error, mean squared error, and root mean squared error, along with greater stability and efficiency in training.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)