Authors

Summary

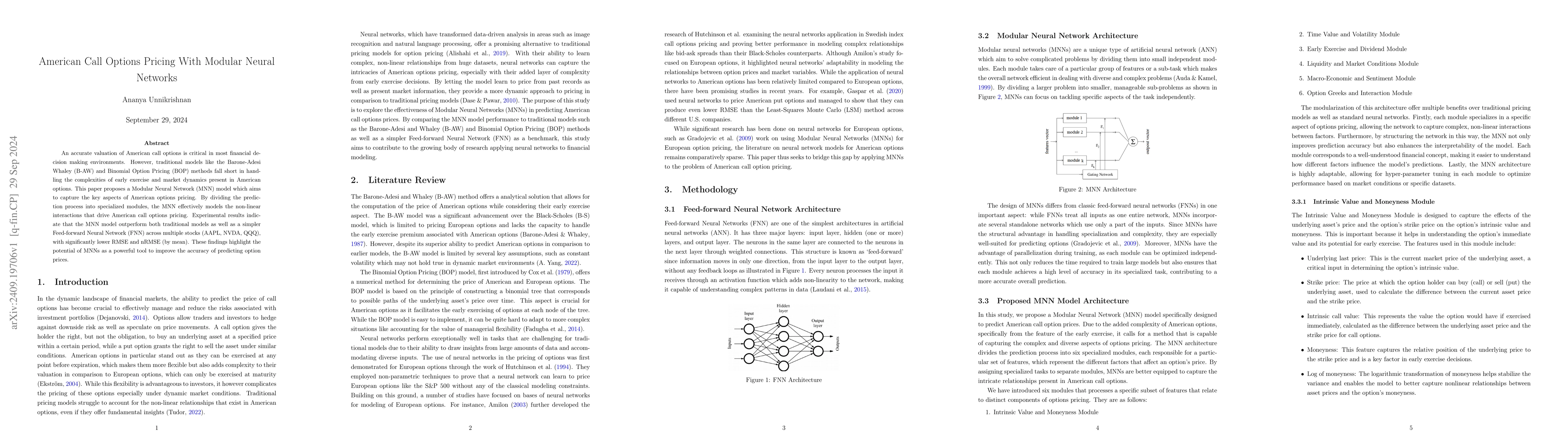

An accurate valuation of American call options is critical in most financial decision making environments. However, traditional models like the Barone-Adesi Whaley (B-AW) and Binomial Option Pricing (BOP) methods fall short in handling the complexities of early exercise and market dynamics present in American options. This paper proposes a Modular Neural Network (MNN) model which aims to capture the key aspects of American options pricing. By dividing the prediction process into specialized modules, the MNN effectively models the non-linear interactions that drive American call options pricing. Experimental results indicate that the MNN model outperform both traditional models as well as a simpler Feed-forward Neural Network (FNN) across multiple stocks (AAPL, NVDA, QQQ), with significantly lower RMSE and nRMSE (by mean). These findings highlight the potential of MNNs as a powerful tool to improve the accuracy of predicting option prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)