Summary

In this paper we investigate a nonlinear generalization of the Black-Scholes equation for pricing American style call options in which the volatility term may depend on the underlying asset price and the Gamma of the option. We propose a numerical method for pricing American style call options by means of transformation of the free boundary problem for a nonlinear Black-Scholes equation into the so-called Gamma variational inequality with the new variable depending on the Gamma of the option. We apply a modified projective successive over relaxation method in order to construct an effective numerical scheme for discretization of the Gamma variational inequality. Finally, we present several computational examples for the nonlinear Black-Scholes equation for pricing American style call option under presence of variable transaction costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

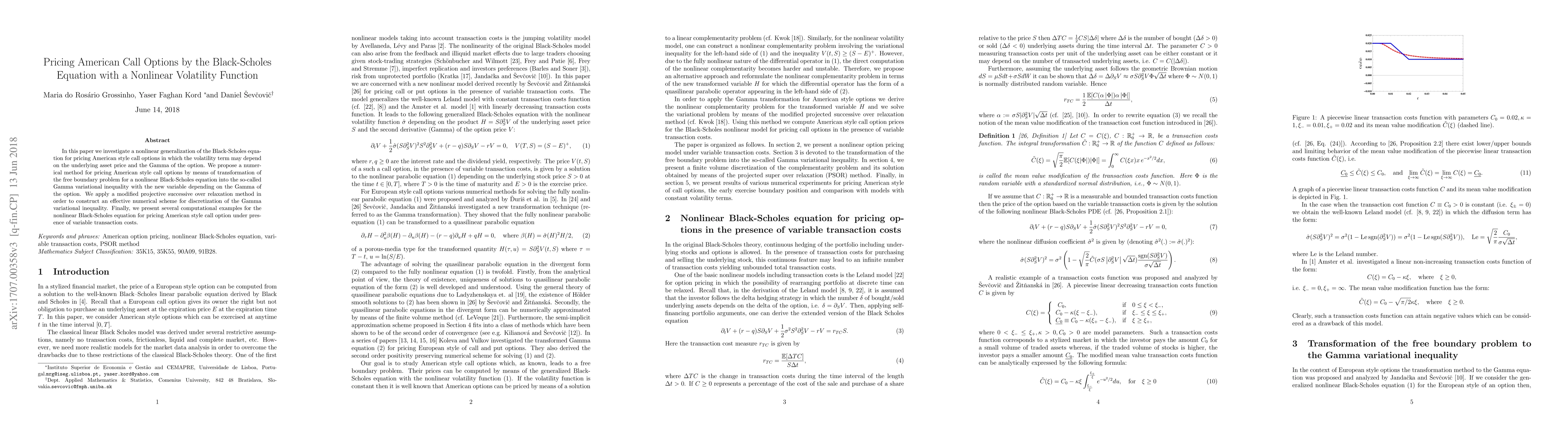

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)