Andrei Neagu

2 papers on arXiv

Academic Profile

Statistics

arXiv Papers

2

Total Publications

1

Similar Authors

Papers on arXiv

Deep Hedging with Market Impact

Dynamic hedging is the practice of periodically transacting financial instruments to offset the risk caused by an investment or a liability. Dynamic hedging optimization can be framed as a sequentia...

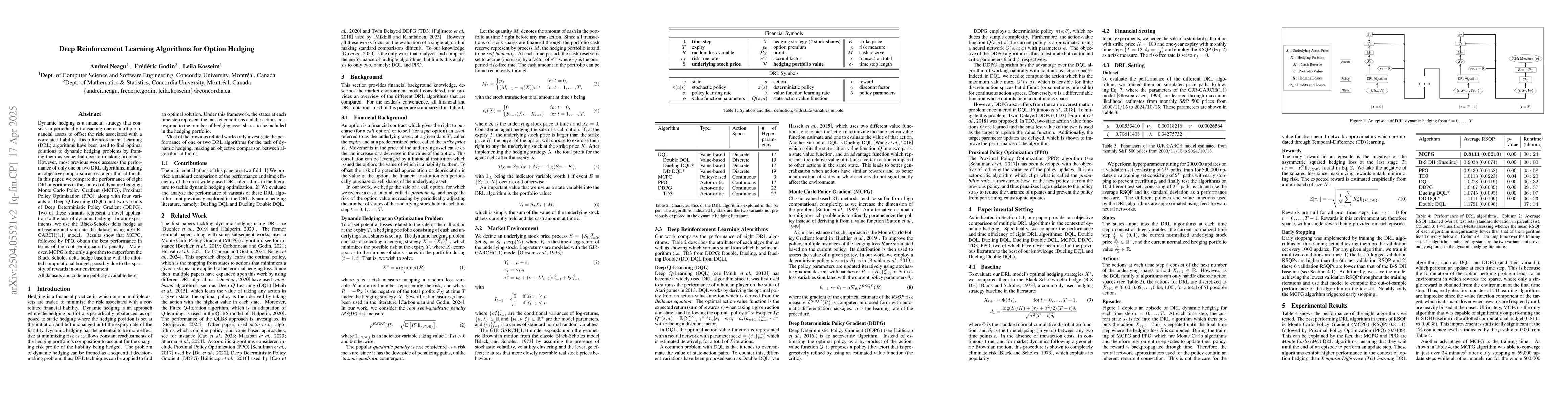

Deep Reinforcement Learning Algorithms for Option Hedging

Dynamic hedging is a financial strategy that consists in periodically transacting one or multiple financial assets to offset the risk associated with a correlated liability. Deep Reinforcement Learnin...