Authors

Summary

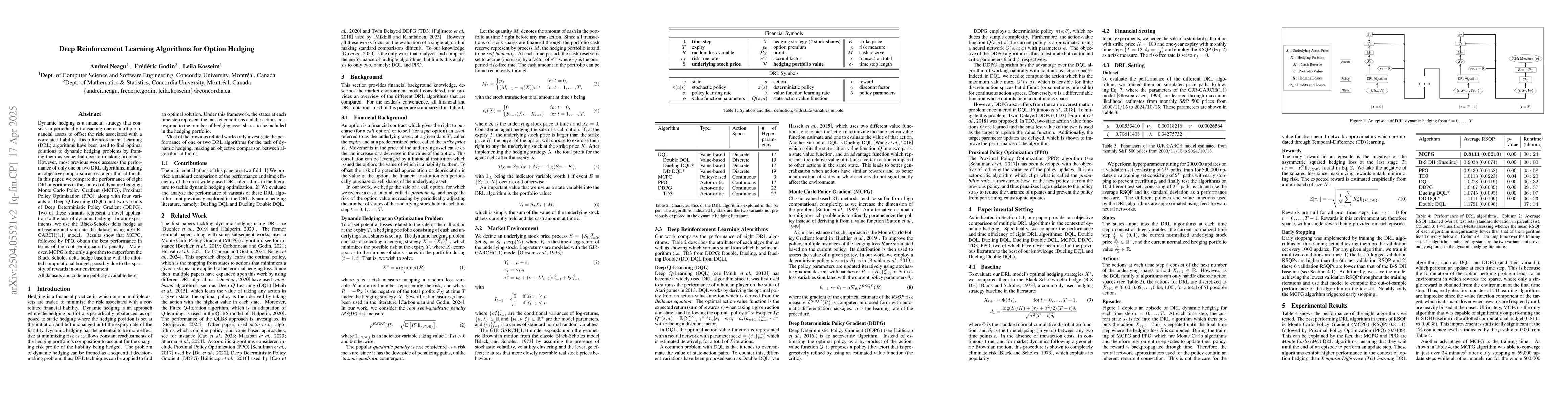

Dynamic hedging is a financial strategy that consists in periodically transacting one or multiple financial assets to offset the risk associated with a correlated liability. Deep Reinforcement Learning (DRL) algorithms have been used to find optimal solutions to dynamic hedging problems by framing them as sequential decision-making problems. However, most previous work assesses the performance of only one or two DRL algorithms, making an objective comparison across algorithms difficult. In this paper, we compare the performance of eight DRL algorithms in the context of dynamic hedging; Monte Carlo Policy Gradient (MCPG), Proximal Policy Optimization (PPO), along with four variants of Deep Q-Learning (DQL) and two variants of Deep Deterministic Policy Gradient (DDPG). Two of these variants represent a novel application to the task of dynamic hedging. In our experiments, we use the Black-Scholes delta hedge as a baseline and simulate the dataset using a GJR-GARCH(1,1) model. Results show that MCPG, followed by PPO, obtain the best performance in terms of the root semi-quadratic penalty. Moreover, MCPG is the only algorithm to outperform the Black-Scholes delta hedge baseline with the allotted computational budget, possibly due to the sparsity of rewards in our environment.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research compares the performance of eight Deep Reinforcement Learning (DRL) algorithms for dynamic hedging, including Monte Carlo Policy Gradient (MCPG), Proximal Policy Optimization (PPO), and variants of Deep Q-Learning (DQL) and Deep Deterministic Policy Gradient (DDPG). Experiments are conducted using the Black-Scholes delta hedge as a baseline and datasets simulated via a GJR-GARCH(1,1) model.

Key Results

- MCPG and PPO show the best performance in terms of the root semi-quadratic penalty.

- MCPG is the only algorithm to outperform the Black-Scholes delta hedge baseline within the given computational budget.

Significance

This research is significant as it provides an objective comparison of multiple DRL algorithms for dynamic hedging, which is crucial for financial risk management, and identifies MCPG as a potentially superior method under specific conditions.

Technical Contribution

The paper presents a comparative analysis of various DRL algorithms for dynamic hedging, offering insights into their relative performance and identifying MCPG as a promising approach.

Novelty

This work distinguishes itself by comparing a broader range of DRL algorithms for dynamic hedging, going beyond previous studies that typically assess only one or two algorithms.

Limitations

- The study is limited to the specific dataset generated by the GJR-GARCH(1,1) model.

- Computational budget constraints might affect the generalizability of results for larger, more complex datasets.

Future Work

- Investigate the performance of these algorithms on diverse datasets and real-world financial scenarios.

- Explore the scalability of MCPG for handling larger and more complex hedging problems.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimizing Deep Reinforcement Learning for American Put Option Hedging

Reilly Pickard, F. Wredenhagen, Y. Lawryshyn

Applying Reinforcement Learning to Option Pricing and Hedging

Zoran Stoiljkovic

Reinforcement Learning for Credit Index Option Hedging

Marco Pinciroli, Michele Trapletti, Edoardo Vittori et al.

Option Dynamic Hedging Using Reinforcement Learning

Can Yang, Cong Zheng, Jiafa He

No citations found for this paper.

Comments (0)