Beatrice Acciaio

15 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Multicausal transport: barycenters and dynamic matching

We introduce a multivariate version of adapted transport, which we name multicausal transport, involving several filtered processes among which causality constraints are imposed. Subsequently, we co...

Optimal reinsurance from an optimal transport perspective

We regard the optimal reinsurance problem as an iterated optimal transport problem between a (known) initial and an (unknown) resulting risk exposure of the insurer. We also provide conditions that ...

Calibration of the Bass Local Volatility model

The Bass local volatility model introduced by Backhoff-Veraguas--Beiglb\"ock--Huesmann--K\"allblad is a Markov model perfectly calibrated to vanilla options at finitely many maturities, that approxi...

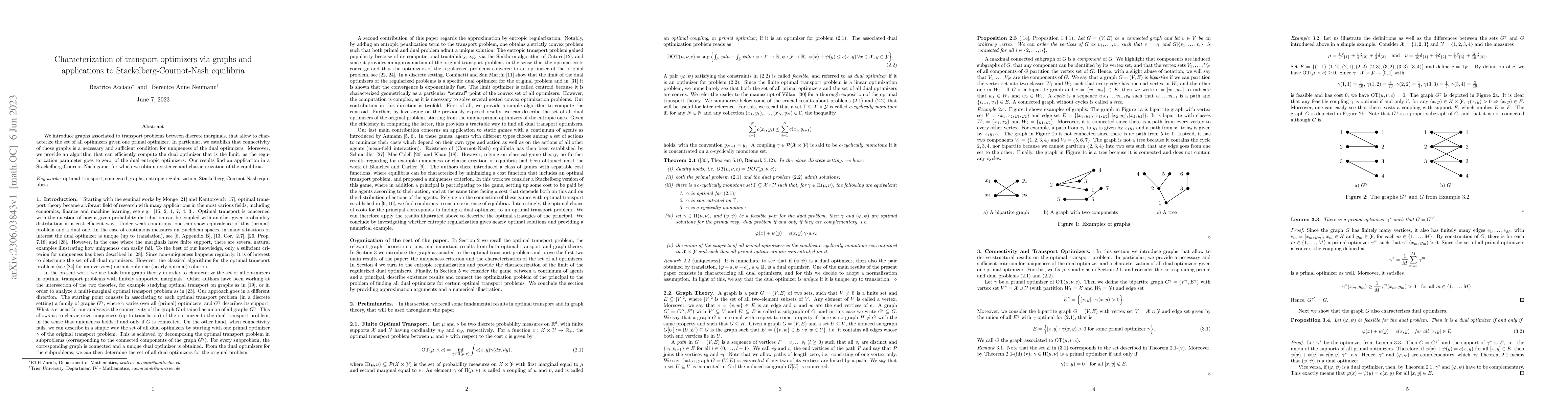

Characterization of transport optimizers via graphs and applications to Stackelberg-Cournot-Nash equilibria

We introduce graphs associated to transport problems between discrete marginals, that allow to characterize the set of all optimizers given one primal optimizer. In particular, we establish that con...

Convergence of Adapted Empirical Measures on $\mathbb{R}^{d}$

We consider empirical measures of $\R^{d}$-valued stochastic process in finite discrete-time. We show that the adapted empirical measure introduced in the recent work \cite{backhoff2022estimating} b...

Quantitative Fundamental Theorem of Asset Pricing

In this paper we provide a quantitative analysis to the concept of arbitrage, that allows to deal with model uncertainty without imposing the no-arbitrage condition. In markets that admit ``small ar...

A short proof of the characterisation of convex order using the 2-Wasserstein distance

We provide a short proof of the intriguing characterisation of the convex order given by Wiesel and Zhang.

Designing Universal Causal Deep Learning Models: The Geometric (Hyper)Transformer

Several problems in stochastic analysis are defined through their geometry, and preserving that geometric structure is essential to generating meaningful predictions. Nevertheless, how to design pri...

Conditional COT-GAN for Video Prediction with Kernel Smoothing

Causal Optimal Transport (COT) results from imposing a temporal causality constraint on classic optimal transport problems, which naturally generates a new concept of distances between distributions...

Weak Transport for Non-Convex Costs and Model-independence in a Fixed-Income Market

We consider a model-independent pricing problem in a fixed-income market and show that it leads to a weak optimal transport problem as introduced by Gozlan et al. We use this to characterize the ext...

Time-Causal VAE: Robust Financial Time Series Generator

We build a time-causal variational autoencoder (TC-VAE) for robust generation of financial time series data. Our approach imposes a causality constraint on the encoder and decoder networks, ensuring a...

Entropic adapted Wasserstein distance on Gaussians

The adapted Wasserstein distance is a metric for quantifying distributional uncertainty and assessing the sensitivity of stochastic optimization problems on time series data. A computationally efficie...

Estimating causal distances with non-causal ones

The adapted Wasserstein ($AW$) distance refines the classical Wasserstein ($W$) distance by incorporating the temporal structure of stochastic processes. This makes the $AW$-distance well-suited as a ...

Absolutely Continuous Curves of Stochastic Processes

We study absolutely continuous curves in the adapted Wasserstein space of filtered processes. We provide a probabilistic representation of such curves as flows of adapted processes on a common filtere...

Strassen's theorem for biased convex order

Strassen's theorem asserts that for given marginal probabilities $\mu,\nu$ there exists a martingale starting in $\mu$ and terminating in $\nu$ if and only if $\mu,\nu$ are in convex order. From a fin...