Summary

The Bass local volatility model introduced by Backhoff-Veraguas--Beiglb\"ock--Huesmann--K\"allblad is a Markov model perfectly calibrated to vanilla options at finitely many maturities, that approximates the Dupire local volatility model. Conze and Henry-Labord\`ere show that its calibration can be achieved by solving a fixed-point equation. In this paper we complement the analysis and show existence and uniqueness of the solution to this equation, and that the fixed-point iteration scheme converges at a linear rate.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

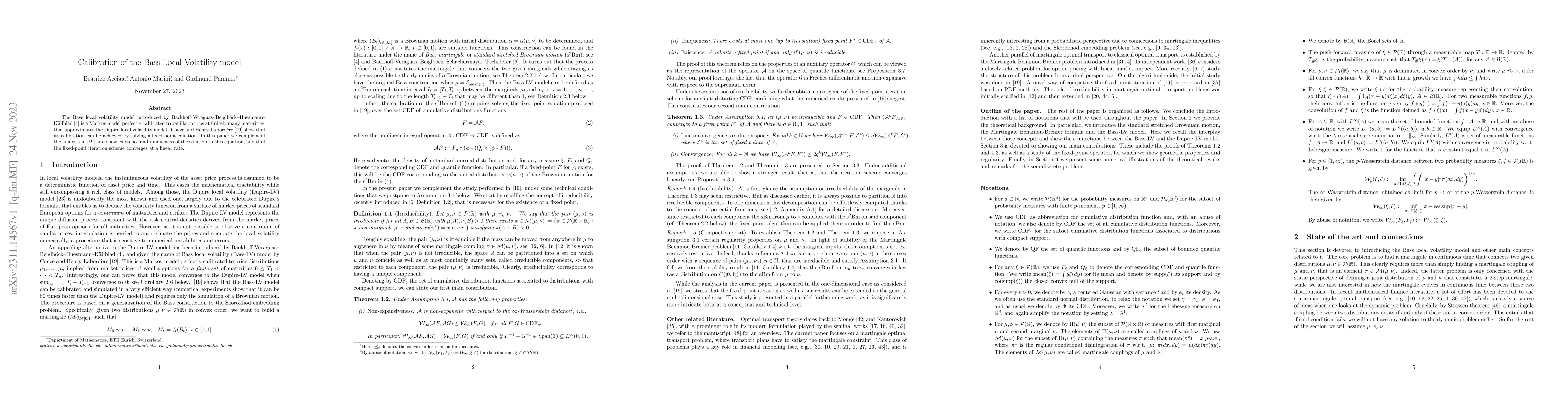

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust and Fast Bass local volatility

Hao Qin, Charlie Che, Ruozhong Yang et al.

Volatility Calibration via Automatic Local Regression

Hao Qin, Charlie Che, Ruozhong Yang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)