Emanuela Rosazza Gianin

11 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Geometric BSDEs

We introduce and develop the concepts of Geometric Backward Stochastic Differential Equations (GBSDEs, for short) and two-driver BSDEs. We demonstrate their natural suitability for modeling dynamic ...

Cash non-additive risk measures: horizon risk and generalized entropy

Horizon risk (see arXiv:2301.04971) is studied in the context of cash non-additive fully-dynamic risk measures induced by BSDEs. Furthermore, we introduce a risk measure based on generalized Tsallis...

Law-Invariant Return and Star-Shaped Risk Measures

This paper presents novel characterization results for classes of law-invariant star-shaped functionals. We begin by establishing characterizations for positively homogeneous and star-shaped functio...

Dynamic Return and Star-Shaped Risk Measures via BSDEs

This paper establishes characterization results for dynamic return and star-shaped risk measures induced via backward stochastic differential equations (BSDEs). We first characterize a general famil...

Are Shortfall Systemic Risk Measures One Dimensional?

Shortfall systemic (multivariate) risk measures $\rho$ defined through an $N$-dimensional multivariate utility function $U$ and random allocations can be represented as classical (one dimensional) s...

Capital allocation for cash-subadditive risk measures: from BSDEs to BSVIEs

In the context of risk measures, the capital allocation problem is widely studied in the literature where different approaches have been developed, also in connection with cooperative game theory an...

Fully-dynamic risk measures: horizon risk, time-consistency, and relations with BSDEs and BSVIEs

In a dynamic framework, we identify a new concept associated with the risk of assessing the financial exposure by a measure that is not adequate to the actual time horizon of the position. This will...

Quasi-Logconvex Measures of Risk

This paper introduces and fully characterizes the novel class of quasi-logconvex measures of risk, to stand on equal footing with the rich class of quasi-convex measures of risk. Quasi-logconvex ris...

Dynamic capital allocation rules via BSDEs: an axiomatic approach

In this paper, we study capital allocation for dynamic risk measures, with an axiomatic approach but also by exploiting the relation between risk measures and BSDEs. Although there is a wide literat...

SIG-BSDE for Dynamic Risk Measures

In this paper, we consider dynamic risk measures induced by backward stochastic differential equations (BSDEs). We discuss different examples that come up in the literature, including the entropic ris...

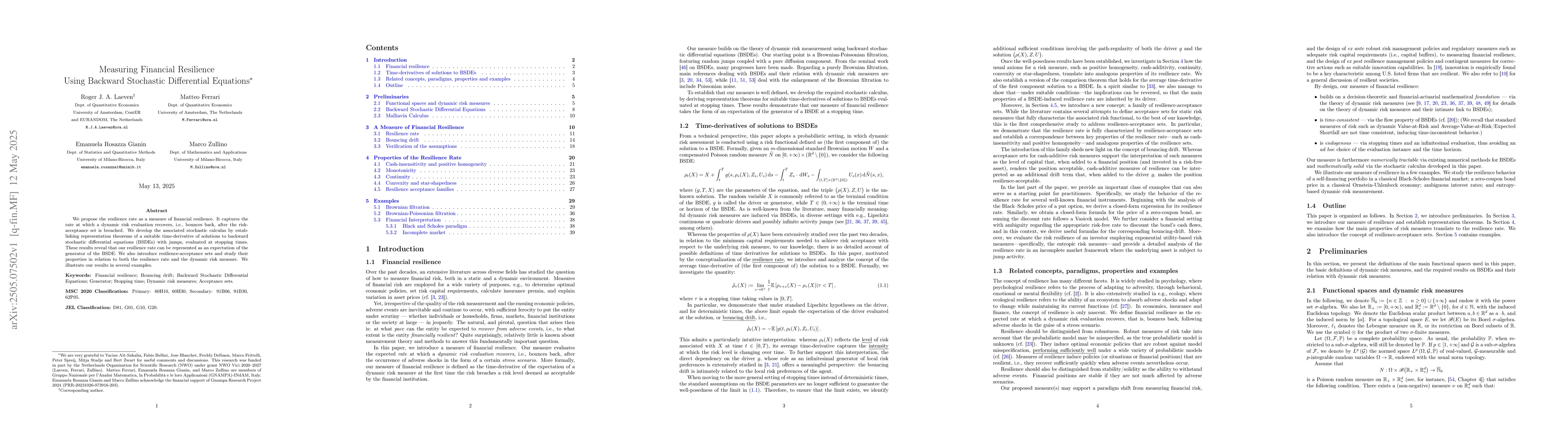

Measuring Financial Resilience Using Backward Stochastic Differential Equations

We propose the resilience rate as a measure of financial resilience. It captures the rate at which a dynamic risk evaluation recovers, i.e., bounces back, after the risk-acceptance set is breached. We...