Summary

We propose the resilience rate as a measure of financial resilience. It captures the rate at which a dynamic risk evaluation recovers, i.e., bounces back, after the risk-acceptance set is breached. We develop the associated stochastic calculus by establishing representation theorems of a suitable time-derivative of solutions to backward stochastic differential equations (BSDEs) with jumps, evaluated at stopping times. These results reveal that our resilience rate can be represented as an expectation of the generator of the BSDE. We also introduce resilience-acceptance sets and study their properties in relation to both the resilience rate and the dynamic risk measure. We illustrate our results in several examples.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper proposes the resilience rate as a measure of financial resilience, developing stochastic calculus using representation theorems for a suitable time-derivative of solutions to backward stochastic differential equations (BSDEs) with jumps, evaluated at stopping times.

Key Results

- Introduction of the resilience rate to capture the recovery rate after risk-acceptance set breach.

- Representation theorems showing the resilience rate as an expectation of the generator of the BSDE.

Significance

This research provides a novel method for measuring financial resilience, which can be beneficial for risk management and financial decision-making in uncertain environments.

Technical Contribution

The development of representation theorems for time-derivatives of BSDE solutions with jumps, evaluated at stopping times, to represent the resilience rate.

Novelty

The paper introduces the concept of resilience rate and associated stochastic calculus, differentiating itself by focusing on dynamic risk evaluation recovery post-breach of the risk-acceptance set.

Limitations

- The paper does not discuss potential limitations or assumptions of the proposed methodology explicitly.

- Real-world applicability and empirical validation are not addressed.

Future Work

- Exploration of practical applications and case studies to validate the proposed resilience rate measure.

- Investigation into the impact of different jump processes on the resilience rate.

Paper Details

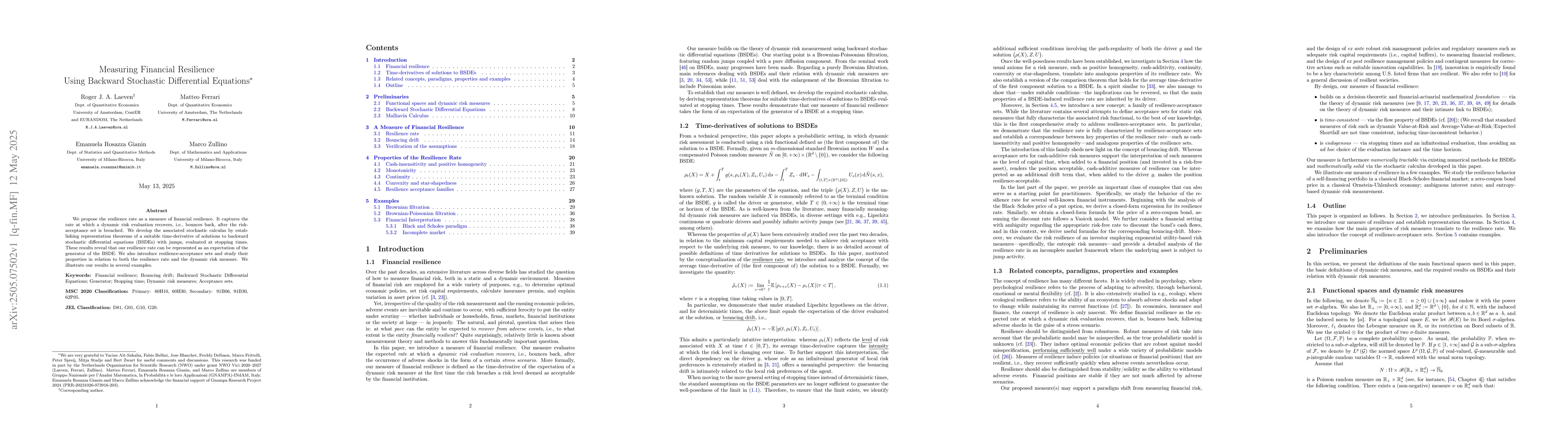

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)