Eyal Neuman

20 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

The Mercer-Young Theorem for Matrix-Valued Kernels on Separable Metric Spaces

We generalize the characterization theorem going back to Mercer and Young, which states that a symmetric and continuous kernel is positive definite if and only if it is integrally positive definite....

Optimal Portfolio Choice with Cross-Impact Propagators

We consider a class of optimal portfolio choice problems in continuous time where the agent's transactions create both transient cross-impact driven by a matrix-valued Volterra propagator, as well a...

An Offline Learning Approach to Propagator Models

We consider an offline learning problem for an agent who first estimates an unknown price impact kernel from a static dataset, and then designs strategies to liquidate a risky asset while creating t...

Equilibrium in Functional Stochastic Games with Mean-Field Interaction

We consider a general class of finite-player stochastic games with mean-field interaction, in which the linear-quadratic cost functional includes linear operators acting on controls in $L^2$. We pro...

The radius of a self-repelling star polymer

We study the effective radius of weakly self-avoiding star polymers in one, two, and three dimensions. Our model includes $N$ Brownian motions up to time $T$, started at the origin and subject to ex...

Statistical Learning with Sublinear Regret of Propagator Models

We consider a class of learning problems in which an agent liquidates a risky asset while creating both transient price impact driven by an unknown convolution propagator and linear temporary price ...

Optimal Liquidation with Signals: the General Propagator Case

We consider a class of optimal liquidation problems where the agent's transactions create transient price impact driven by a Volterra-type propagator along with temporary price impact. We formulate ...

Fast and Slow Optimal Trading with Exogenous Information

We consider a stochastic game between a slow institutional investor and a high-frequency trader who are trading a risky asset and their aggregated order-flow impacts the asset price. We model this s...

Self-Repelling Elastic Manifolds with Low Dimensional Range

We consider self-repelling elastic manifolds with a domain $[-N,N]^d \cap \mathbb{Z}^d$, that take values in $\mathbb{R}^D$. Our main result states that when the dimension of the domain is $d=2$ and...

The Effective Radius of Self Repelling Elastic Manifolds

We study elastic manifolds with self-repelling terms and estimate their effective radius. This class of manifolds is modelled by a self-repelling vector-valued Gaussian free field with Neumann bound...

Closed-Loop Nash Competition for Liquidity

We study a multi-player stochastic differential game, where agents interact through their joint price impact on an asset that they trade to exploit a common trading signal. In this context, we prove...

Trading with the Crowd

We formulate and solve a multi-player stochastic differential game between financial agents who seek to cost-efficiently liquidate their position in a risky asset in the presence of jointly aggregat...

Evidence of Crowding on Russell 3000 Reconstitution Events

We develop a methodology which replicates in great accuracy the FTSE Russell indexes reconstitutions, including the quarterly rebalancings due to new initial public offerings (IPOs). While using onl...

Optimal Signal-Adaptive Trading with Temporary and Transient Price Impact

We study optimal liquidation in the presence of linear temporary and transient price impact along with taking into account a general price predicting finite-variation signal. We formulate this probl...

Unwinding Toxic Flow with Partial Information

We consider a central trading desk which aggregates the inflow of clients' orders with unobserved toxicity, i.e. persistent adverse directionality. The desk chooses either to internalise the inflow or...

Fluid-Limits of Fragmented Limit-Order Markets

Maglaras, Moallemi, and Zheng (2021) have introduced a flexible queueing model for fragmented limit-order markets, whose fluid limit remains remarkably tractable. In the present study we prove that, i...

Stochastic Graphon Games with Memory

We study finite-player dynamic stochastic games with heterogeneous interactions and non-Markovian linear-quadratic objective functionals. We derive the Nash equilibrium explicitly by converting the fi...

Fredholm Approach to Nonlinear Propagator Models

We formulate and solve an optimal trading problem with alpha signals, where transactions induce a nonlinear transient price impact described by a general propagator model, including power-law decay. U...

Stochastic Graphon Games with Interventions

We consider a class of targeted intervention problems in dynamic network and graphon games. First, we study a general dynamic network game in which players interact over a graph and maximize their het...

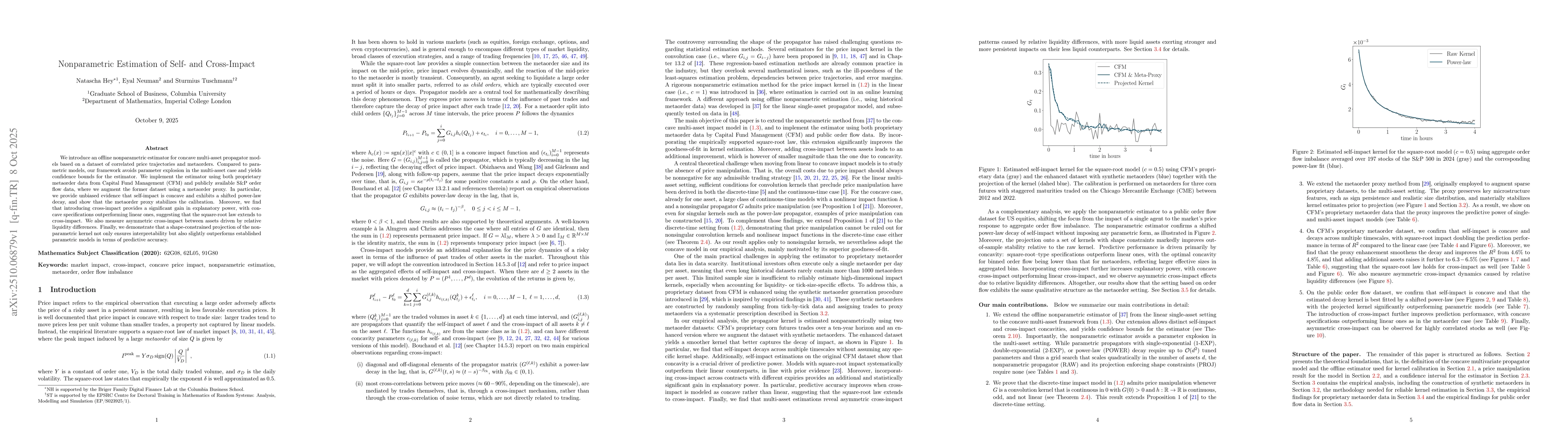

Nonparametric Estimation of Self- and Cross-Impact

We introduce an offline nonparametric estimator for concave multi-asset propagator models based on a dataset of correlated price trajectories and metaorders. Compared to parametric models, our framewo...