Summary

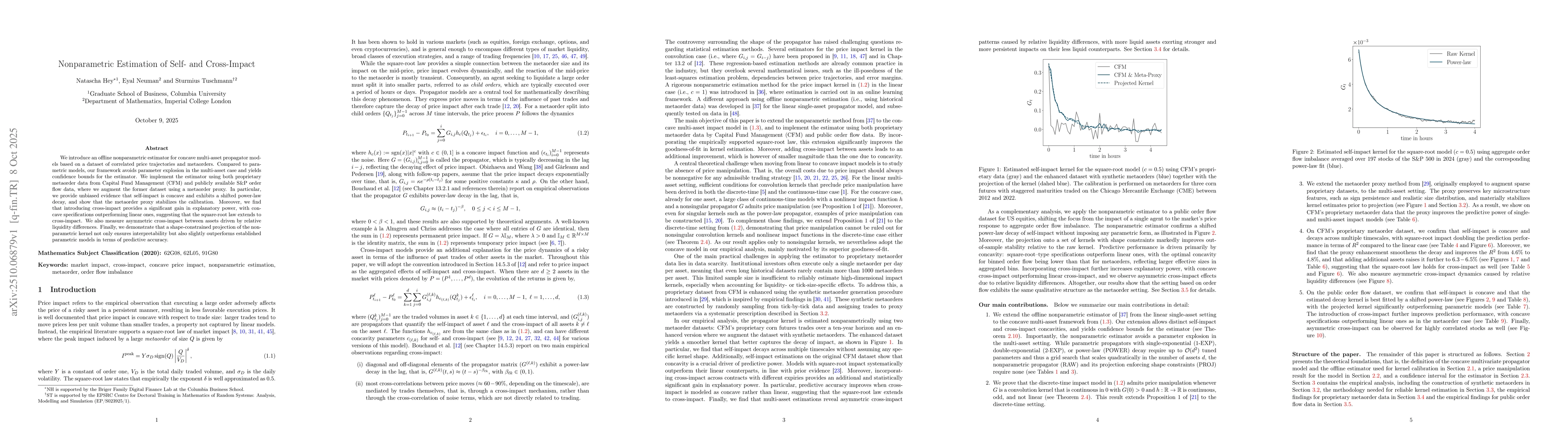

We introduce an offline nonparametric estimator for concave multi-asset propagator models based on a dataset of correlated price trajectories and metaorders. Compared to parametric models, our framework avoids parameter explosion in the multi-asset case and yields confidence bounds for the estimator. We implement the estimator using both proprietary metaorder data from Capital Fund Management (CFM) and publicly available S&P order flow data, where we augment the former dataset using a metaorder proxy. In particular, we provide unbiased evidence that self-impact is concave and exhibits a shifted power-law decay, and show that the metaorder proxy stabilizes the calibration. Moreover, we find that introducing cross-impact provides a significant gain in explanatory power, with concave specifications outperforming linear ones, suggesting that the square-root law extends to cross-impact. We also measure asymmetric cross-impact between assets driven by relative liquidity differences. Finally, we demonstrate that a shape-constrained projection of the nonparametric kernel not only ensures interpretability but also slightly outperforms established parametric models in terms of predictive accuracy.

AI Key Findings

Generated Oct 09, 2025

Methodology

The research employs a combination of empirical analysis and theoretical modeling to study market impact and cross-impact effects. It uses high-frequency trading data and non-parametric estimation techniques to analyze the behavior of price impacts across multiple assets.

Key Results

- The study finds that cross-impact effects are significant and symmetric between highly correlated assets.

- Non-linear price impact models, particularly those with square-root decay, outperform linear models in capturing market dynamics.

- The liquidity gradient between assets influences the strength and direction of cross-impact effects.

Significance

This research provides critical insights into market microstructure and the behavior of price impacts, which has implications for optimal trading strategies, market regulation, and the design of financial systems.

Technical Contribution

The paper introduces a non-parametric framework for estimating multi-asset price impact matrices and demonstrates its application to real-world financial data, providing a robust method for analyzing complex market interactions.

Novelty

This work is novel in its comprehensive analysis of cross-impact effects across multiple assets using non-parametric methods, and in its demonstration of how liquidity gradients influence these interactions in a multi-asset framework.

Limitations

- The analysis is based on historical data and may not capture future market behavior or extreme events.

- The study focuses on specific assets and markets, limiting generalizability to other financial instruments or regions.

Future Work

- Extending the analysis to include more diverse asset classes and global markets.

- Investigating the impact of regulatory changes on cross-impact dynamics.

- Developing real-time adaptive models for trading strategies based on cross-impact patterns.

Comments (0)