Hamed Amini

13 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Observed quantum particles system with graphon interaction

In this paper, we consider a system of heterogeneously interacting quantum particles subject to indirect continuous measurement. The interaction is assumed to be of the mean-field type. We derive a ...

Ruin-dependent bivariate stochastic fluid processes

This paper presents a novel model for bivariate stochastic fluid processes that incorporate a ruin-dependent behavioral switch. Unlike typical models that assume a shared underlying process, our mod...

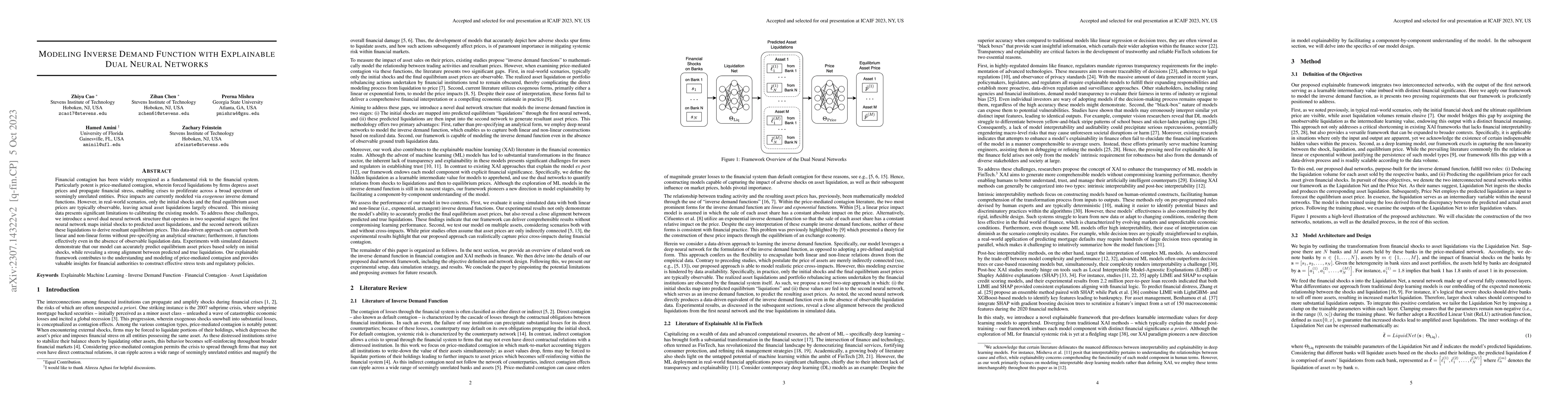

Modeling Inverse Demand Function with Explainable Dual Neural Networks

Financial contagion has been widely recognized as a fundamental risk to the financial system. Particularly potent is price-mediated contagion, wherein forced liquidations by firms depress asset pric...

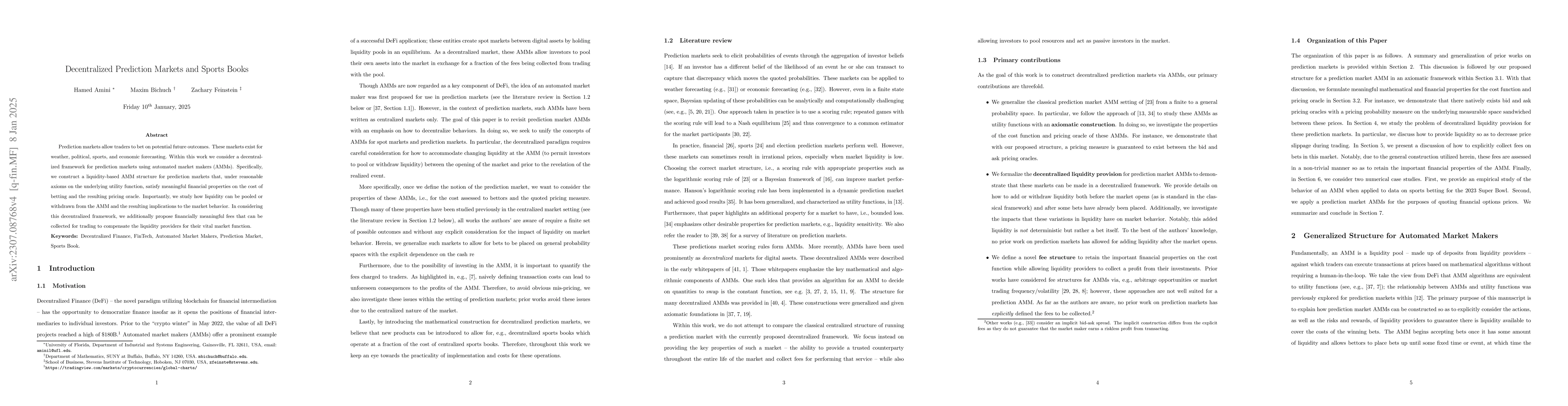

Decentralized Prediction Markets and Sports Books

Prediction markets allow traders to bet on potential future outcomes. These markets exist for weather, political, sports, and economic forecasting. Within this work we consider a decentralized frame...

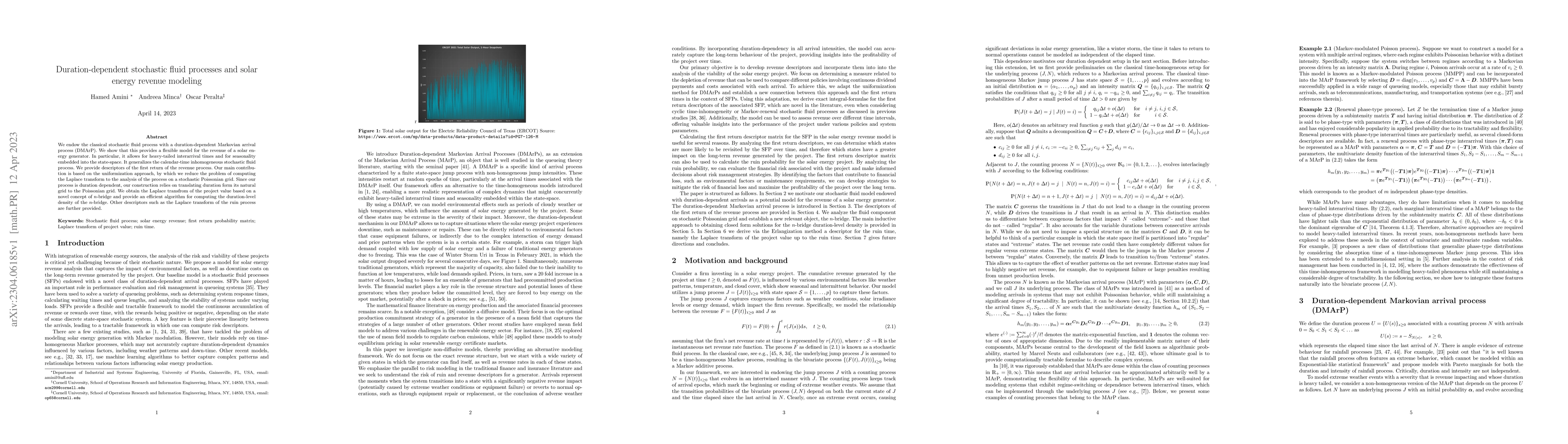

Duration-dependent stochastic fluid processes and solar energy revenue modeling

We endow the classical stochastic fluid process with a duration-dependent Markovian arrival process (DMArP). We show that this provides a flexible model for the revenue of a solar energy generator. ...

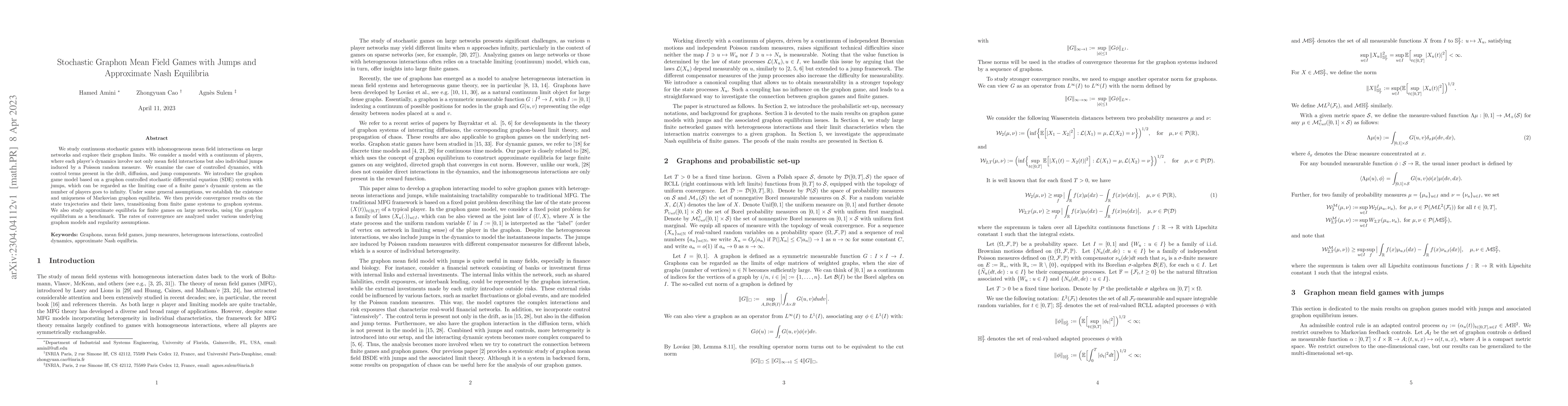

Stochastic Graphon Mean Field Games with Jumps and Approximate Nash Equilibria

We study continuous stochastic games with inhomogeneous mean field interactions on large networks and explore their graphon limits. We consider a model with a continuum of players, where each player...

Ruin Probabilities for Risk Processes in Stochastic Networks

We study multidimensional Cram\'er-Lundberg risk processes where agents, located on a large sparse network, receive losses form their neighbors. To reduce the dimensionality of the problem, we intro...

Decentralized Payment Clearing using Blockchain and Optimal Bidding

In this paper, we construct a decentralized clearing mechanism which endogenously and automatically provides a claims resolution procedure. This mechanism can be used to clear a network of obligatio...

A Central Limit Theorem for Diffusion in Sparse Random Graphs

We consider bootstrap percolation and diffusion in sparse random graphs with fixed degrees, constructed by configuration model. Every node has two states: it is either active or inactive. We assume ...

Optimal Network Compression

This paper introduces a formulation of the optimal network compression problem for financial systems. This general formulation is presented for different levels of network compression or rerouting a...

Epidemic Spreading and Equilibrium Social Distancing in Heterogeneous Networks

We study a multi-type SIR epidemic process among a heterogeneous population that interacts through a network. When we base social contact on a random graph with given vertex degrees, we give limit t...

Graphon Quantum Filtering Systems

We consider a non-exchangeable system of interacting quantum particles with mean-field type interactions, subject to continuous measurement on a class of dense graphs. In the mean-field limit, we deri...

Brownian motion on the Fubini extension space and applications

The aim of this paper is to establish a certain equivalence between a Brownian motion on a Fubini extension space and a collection of essentially pairwise independent Brownian motions on the marginal ...