Johannes Muhle-Karbe

5 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Optimizing Broker Performance Evaluation through Intraday Modeling of Execution Cost

Minimizing execution costs for large orders is a fundamental challenge in finance. Firms often depend on brokers to manage their trades due to limited internal resources for optimizing trading strat...

The Cost of Misspecifying Price Impact

Portfolio managers' orders trade off return and trading cost predictions. Return predictions rely on alpha models, whereas price impact models quantify trading costs. This paper studies what happens...

Closed-Loop Nash Competition for Liquidity

We study a multi-player stochastic differential game, where agents interact through their joint price impact on an asset that they trade to exploit a common trading signal. In this context, we prove...

Fluid-Limits of Fragmented Limit-Order Markets

Maglaras, Moallemi, and Zheng (2021) have introduced a flexible queueing model for fragmented limit-order markets, whose fluid limit remains remarkably tractable. In the present study we prove that, i...

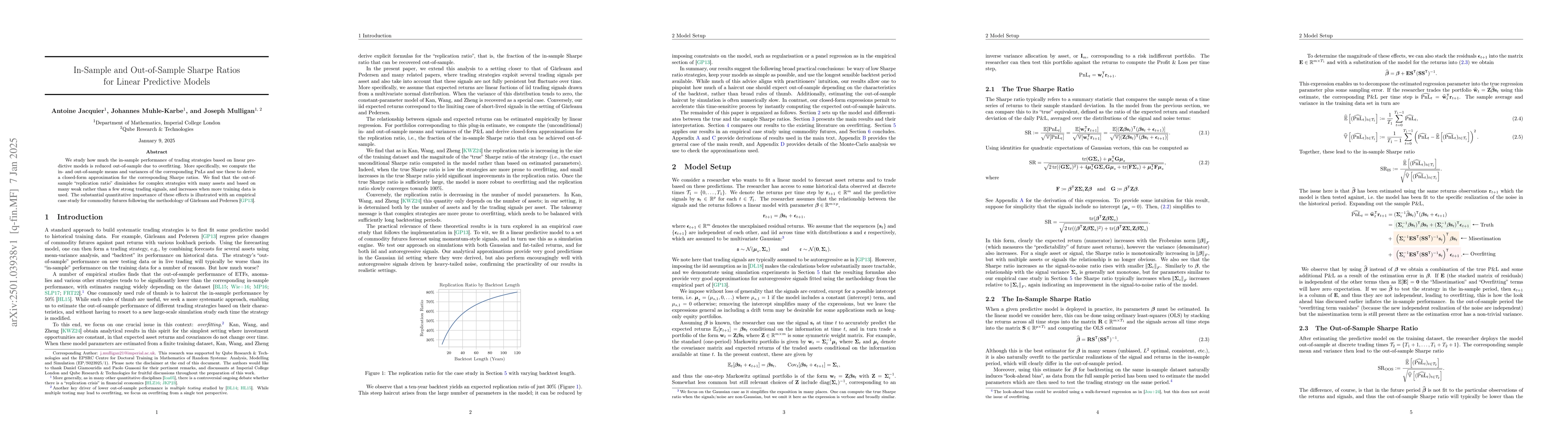

In-Sample and Out-of-Sample Sharpe Ratios for Linear Predictive Models

We study how much the in-sample performance of trading strategies based on linear predictive models is reduced out-of-sample due to overfitting. More specifically, we compute the in- and out-of-sample...