Summary

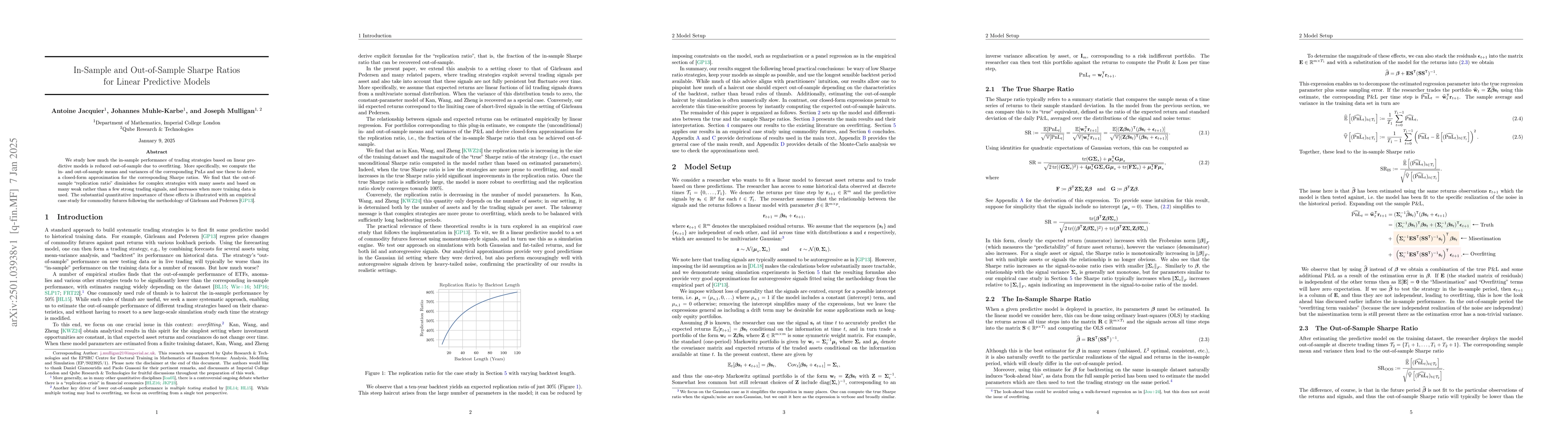

We study how much the in-sample performance of trading strategies based on linear predictive models is reduced out-of-sample due to overfitting. More specifically, we compute the in- and out-of-sample means and variances of the corresponding PnLs and use these to derive a closed-form approximation for the corresponding Sharpe ratios. We find that the out-of-sample ``replication ratio'' diminishes for complex strategies with many assets and based on many weak rather than a few strong trading signals, and increases when more training data is used. The substantial quantitative importance of these effects is illustrated with an empirical case study for commodity futures following the methodology of Garleanu-Pedersen.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEstimation of Out-of-Sample Sharpe Ratio for High Dimensional Portfolio Optimization

Yuan Cao, Xuran Meng, Weichen Wang

Out of Sample Predictability in Predictive Regressions with Many Predictor Candidates

Jean-Yves Pitarakis, Jesus Gonzalo

No citations found for this paper.

Comments (0)