Antoine Jacquier

26 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Operator Deep Smoothing for Implied Volatility

We devise a novel method for implied volatility smoothing based on neural operators. The goal of implied volatility smoothing is to construct a smooth surface that links the collection of prices obs...

Risk premium and rough volatility

One the one hand, rough volatility has been shown to provide a consistent framework to capture the properties of stock price dynamics both under the historical measure and for pricing purposes. On t...

Unsupervised Random Quantum Networks for PDEs

Classical Physics-informed neural networks (PINNs) approximate solutions to PDEs with the help of deep neural networks trained to satisfy the differential operator and the relevant boundary conditio...

Natural Language Processing for Financial Regulation

This article provides an understanding of Natural Language Processing techniques in the framework of financial regulation, more specifically in order to perform semantic matching search between rule...

Quantum Computing for Financial Mathematics

Quantum computing has recently appeared in the headlines of many scientific and popular publications. In the context of quantitative finance, we provide here an overview of its potential.

Transportation-cost inequalities for non-linear Gaussian functionals

We study concentration properties for laws of non-linear Gaussian functionals on metric spaces. Our focus lies on measures with non-Gaussian tail behaviour which are beyond the reach of Talagrand's ...

$\mathfrak{X}$PDE for $\mathfrak{X} \in \{\mathrm{BS},\mathrm{FBS}, \mathrm{P}\}$: a rough volatility context

Recent mathematical advances in the context of rough volatility have highlighted interesting and intricate connections between path-dependent partial differential equations and backward stochastic p...

Interest rate convexity in a Gaussian framework

The contributions of this paper are twofold: we define and investigate the properties of a short rate model driven by a general Gaussian Volterra process and, after defining precisely a notion of co...

Universal Approximation Theorem and error bounds for quantum neural networks and quantum reservoirs

Universal approximation theorems are the foundations of classical neural networks, providing theoretical guarantees that the latter are able to approximate maps of interest. Recent results have show...

Propagation of a carbon price in a credit portfolio through macroeconomic factors

We study how the climate transition through a low-carbon economy, implemented by carbon pricing, propagates in a credit portfolio and precisely describe how carbon price dynamics affects credit risk...

Random neural networks for rough volatility

We construct a deep learning-based numerical algorithm to solve path-dependent partial differential equations arising in the context of rough volatility. Our approach is based on interpreting the PD...

Rough volatility, path-dependent PDEs and weak rates of convergence

In the setting of stochastic Volterra equations, and in particular rough volatility models, we show that conditional expectations are the unique classical solutions to path-dependent PDEs. The latte...

On the large-time behaviour of affine Volterra processes

We show the existence of a stationary measure for a class of multidimensional stochastic Volterra systems of affine type. These processes are in general not Markovian, a shortcoming which hinders th...

Rough multifactor volatility for SPX and VIX options

We provide explicit small-time formulae for the at-the-money implied volatility, skew and curvature in a large class of models, including rough volatility models and their multi-factor versions. Our...

Portfolio optimisation with options

We develop a new analysis for portfolio optimisation with options, tackling the three fundamental issues with this problem: asymmetric options' distributions, high dimensionality and dependence stru...

Large and moderate deviations for importance sampling in the Heston model

We provide a detailed importance sampling analysis for variance reduction in stochastic volatility models. The optimal change of measure is obtained using a variety of results from large and moderat...

Functional quantization of rough volatility and applications to volatility derivatives

We develop a product functional quantization of rough volatility. Since the quantizers can be computed offline, this new technique, built on the insightful works by Luschgy and Pages, becomes a stro...

Large and moderate deviations for stochastic Volterra systems

We provide a unified treatment of pathwise Large and Moderate deviations principles for a general class of multidimensional stochastic Volterra equations with singular kernels, not necessarily of co...

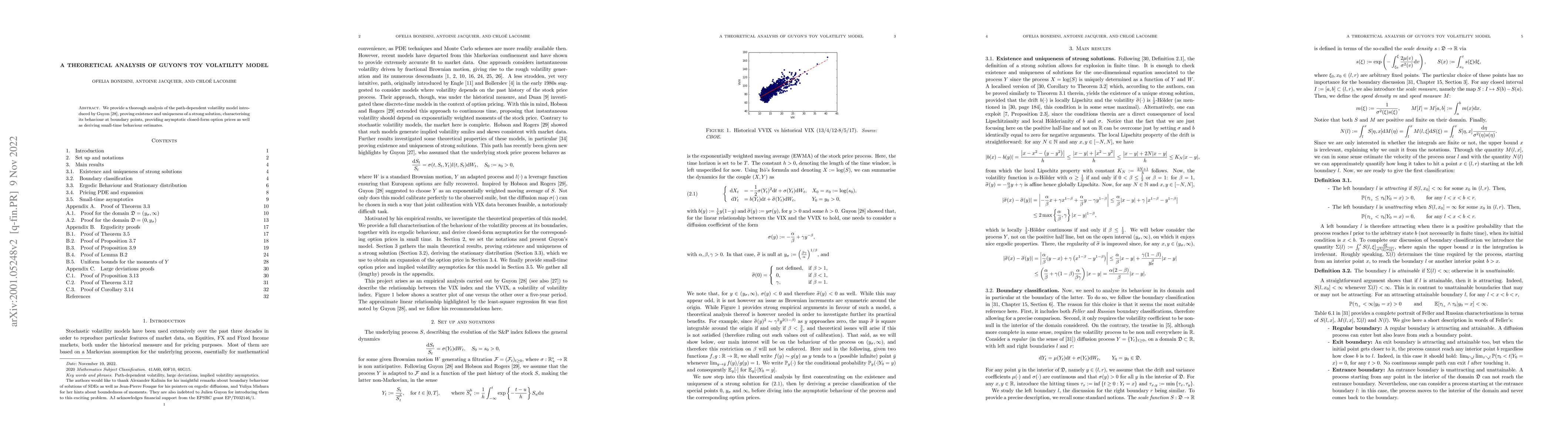

A theoretical analysis of Guyon's toy volatility model

We provide a thorough analysis of the path-dependent volatility model introduced by Guyon \cite{G17}, proving existence and uniqueness of a strong solution, characterising its behaviour at boundary ...

Deep Curve-dependent PDEs for affine rough volatility

We introduce a new deep-learning based algorithm to evaluate options in affine rough stochastic volatility models. Viewing the pricing function as the solution to a curve-dependent PDE (CPDE), depen...

Functional central limit theorems for rough volatility

The non-Markovian nature of rough volatility processes makes Monte Carlo methods challenging and it is in fact a major challenge to develop fast and accurate simulation algorithms. We provide an eff...

Deep learning interpretability for rough volatility

Deep learning methods have become a widespread toolbox for pricing and calibration of financial models. While they often provide new directions and research results, their `black box' nature also resu...

Rough differential equations for volatility

We introduce a canonical way of performing the joint lift of a Brownian motion $W$ and a low-regularity adapted stochastic rough path $\mathbf{X}$, extending [Diehl, Oberhauser and Riedel (2015). A L\...

In-Sample and Out-of-Sample Sharpe Ratios for Linear Predictive Models

We study how much the in-sample performance of trading strategies based on linear predictive models is reduced out-of-sample due to overfitting. More specifically, we compute the in- and out-of-sample...

Rough Bergomi turns grey

We propose a tractable extension of the rough Bergomi model, replacing the fractional Brownian motion with a generalised grey Brownian motion, which we show to be reminiscent of models with stochastic...

Quantum Path Signatures

We elucidate physical aspects of path signatures by formulating randomised path developments within the framework of matrix models in quantum field theory. Using tools from physics, we introduce a new...