Summary

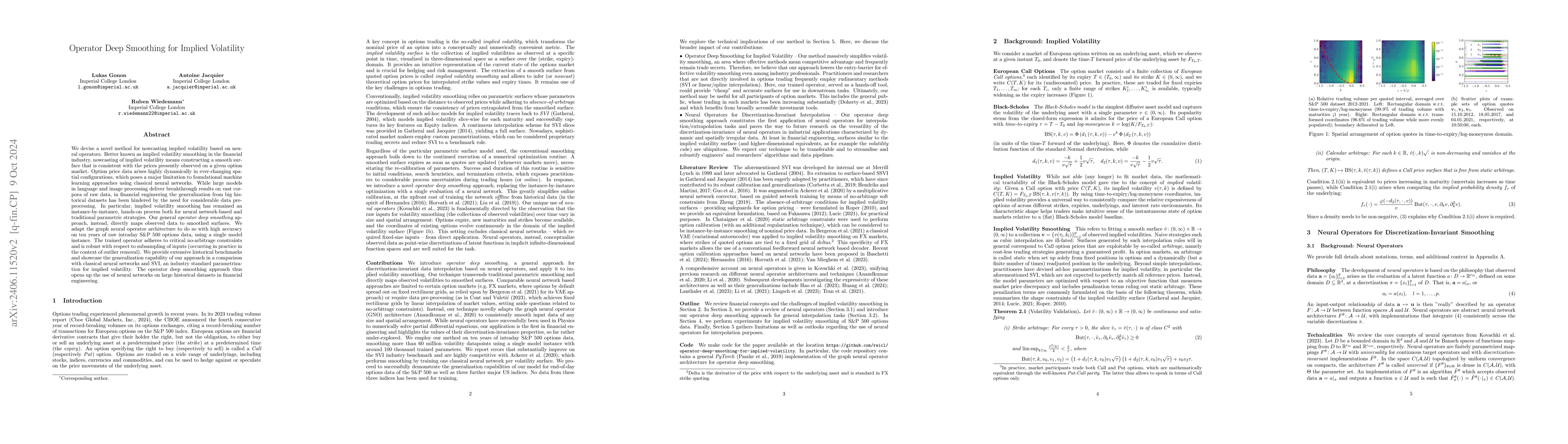

We devise a novel method for implied volatility smoothing based on neural operators. The goal of implied volatility smoothing is to construct a smooth surface that links the collection of prices observed at a specific instant on a given option market. Such price data arises highly dynamically in ever-changing spatial configurations, which poses a major limitation to foundational machine learning approaches using classical neural networks. While large models in language and image processing deliver breakthrough results on vast corpora of raw data, in financial engineering the generalization from big historical datasets has been hindered by the need for considerable data pre-processing. In particular, implied volatility smoothing has remained an instance-by-instance, hands-on process both for neural network-based and traditional parametric strategies. Our general operator deep smoothing approach, instead, directly maps observed data to smoothed surfaces. We adapt the graph neural operator architecture to do so with high accuracy on ten years of raw intraday S&P 500 options data, using a single set of weights. The trained operator adheres to critical no-arbitrage constraints and is robust with respect to subsampling of inputs (occurring in practice in the context of outlier removal). We provide extensive historical benchmarks and showcase the generalization capability of our approach in a comparison with SVI, an industry standard parametrization for implied volatility. The operator deep smoothing approach thus opens up the use of neural networks on large historical datasets in financial engineering.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe ATM implied volatility slope, the (dual) volatility swap, and the (dual) zero vanna implied volatility

Frido Rolloos

Smile asymptotic for Bachelier Implied Volatility

Roberto Baviera, Michele Domenico Massaria

No citations found for this paper.

Comments (0)