Summary

In the setting of stochastic Volterra equations, and in particular rough volatility models, we show that conditional expectations are the unique classical solutions to path-dependent PDEs. The latter arise from the functional It\^o formula developed by [Viens, F., & Zhang, J. (2019). A martingale approach for fractional Brownian motions and related path dependent PDEs. Ann. Appl. Probab.]. We then leverage these tools to study weak rates of convergence for discretised stochastic integrals of smooth functions of a Riemann-Liouville fractional Brownian motion with Hurst parameter $H \in (0,1/2)$. These integrals approximate log-stock prices in rough volatility models. We obtain weak error rates of order 1 if the test function is quadratic and of order $H+1/2$ for smooth test functions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Curve-dependent PDEs for affine rough volatility

Antoine Jacquier, Mugad Oumgari

Volatility models in practice: Rough, Path-dependent or Markovian?

Li, Eduardo Abi Jaber, Shaun

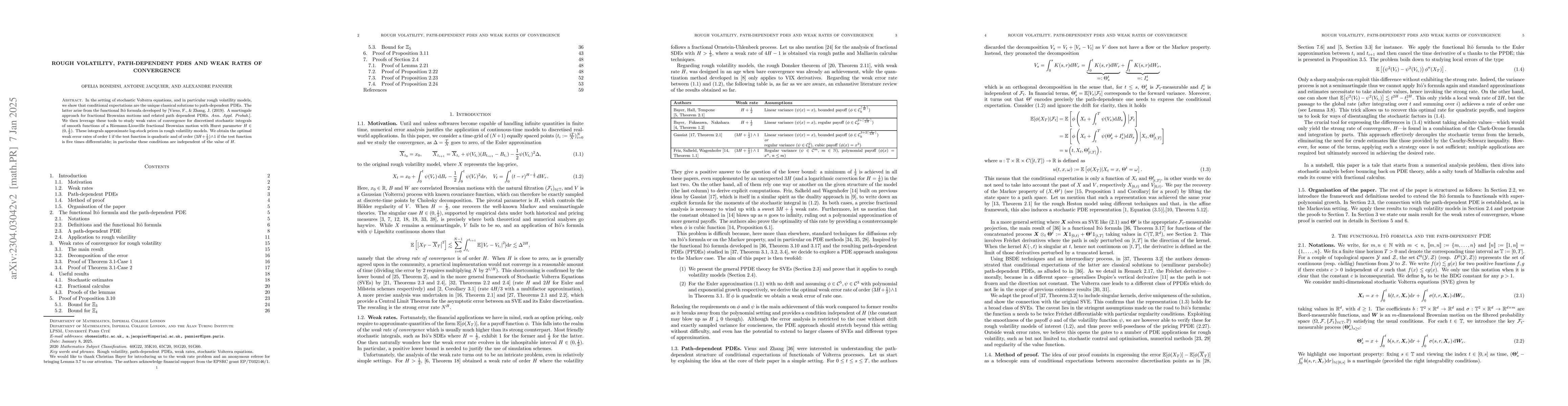

| Title | Authors | Year | Actions |

|---|

Comments (0)