Ofelia Bonesini

10 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Risk premium and rough volatility

One the one hand, rough volatility has been shown to provide a consistent framework to capture the properties of stock price dynamics both under the historical measure and for pricing purposes. On t...

$\mathfrak{X}$PDE for $\mathfrak{X} \in \{\mathrm{BS},\mathrm{FBS}, \mathrm{P}\}$: a rough volatility context

Recent mathematical advances in the context of rough volatility have highlighted interesting and intricate connections between path-dependent partial differential equations and backward stochastic p...

From elephant to goldfish (and back): memory in stochastic Volterra processes

We propose a new theoretical framework that exploits convolution kernels to transform a Volterra path-dependent (non-Markovian) stochastic process into a standard (Markovian) diffusion process. This...

Rough volatility, path-dependent PDEs and weak rates of convergence

In the setting of stochastic Volterra equations, and in particular rough volatility models, we show that conditional expectations are the unique classical solutions to path-dependent PDEs. The latte...

Correlated equilibria for mean field games with progressive strategies

In a discrete space and time framework, we study the mean field game limit for a class of symmetric $N$-player games based on the notion of correlated equilibrium. We give a definition of correlated...

A McKean-Vlasov game of commodity production, consumption and trading

We propose a model where a producer and a consumer can affect the price dynamics of some commodity controlling drift and volatility of, respectively, the production rate and the consumption rate. We...

Functional quantization of rough volatility and applications to volatility derivatives

We develop a product functional quantization of rough volatility. Since the quantizers can be computed offline, this new technique, built on the insightful works by Luschgy and Pages, becomes a stro...

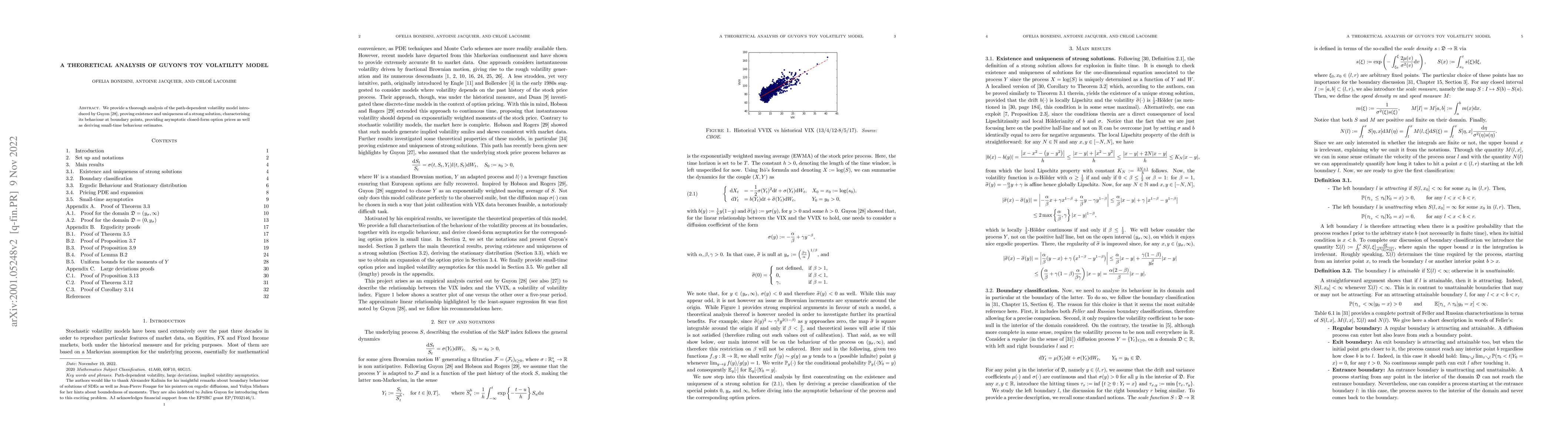

A theoretical analysis of Guyon's toy volatility model

We provide a thorough analysis of the path-dependent volatility model introduced by Guyon \cite{G17}, proving existence and uniqueness of a strong solution, characterising its behaviour at boundary ...

Continuous-time persuasion by filtering

We frame dynamic persuasion in a partial observation stochastic control Leader-Follower game with an ergodic criterion. The Receiver controls the dynamics of a multidimensional unobserved state proces...

Rough differential equations for volatility

We introduce a canonical way of performing the joint lift of a Brownian motion $W$ and a low-regularity adapted stochastic rough path $\mathbf{X}$, extending [Diehl, Oberhauser and Riedel (2015). A L\...