John M. Mulvey

5 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

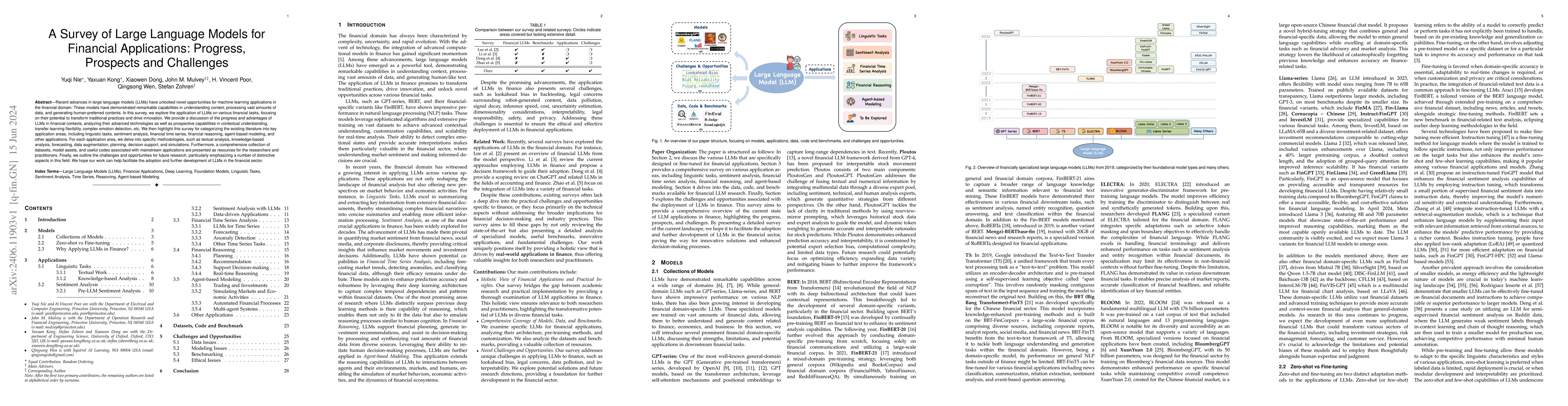

A Survey of Large Language Models for Financial Applications: Progress, Prospects and Challenges

Recent advances in large language models (LLMs) have unlocked novel opportunities for machine learning applications in the financial domain. These models have demonstrated remarkable capabilities in...

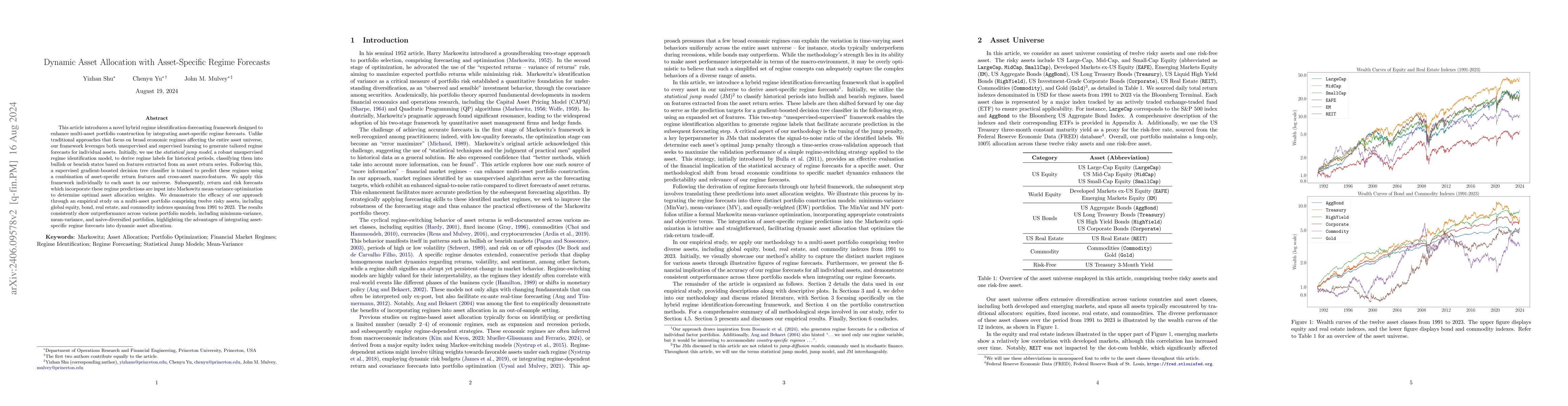

Dynamic Asset Allocation with Asset-Specific Regime Forecasts

This article introduces a novel hybrid regime identification-forecasting framework designed to enhance multi-asset portfolio construction by integrating asset-specific regime forecasts. Unlike tradi...

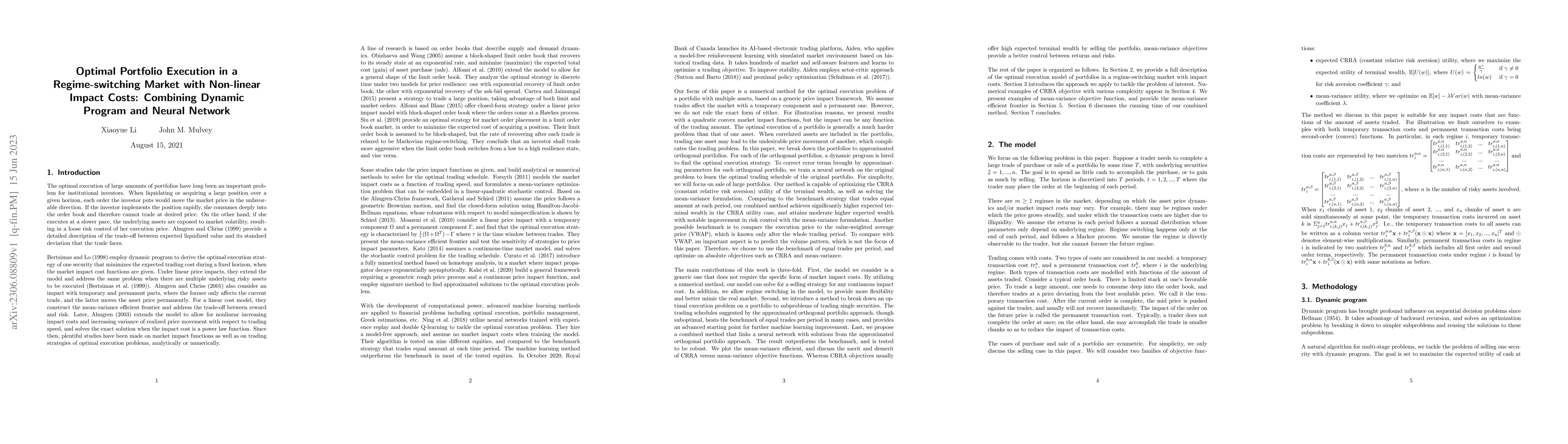

Optimal Portfolio Execution in a Regime-switching Market with Non-linear Impact Costs: Combining Dynamic Program and Neural Network

Optimal execution of a portfolio have been a challenging problem for institutional investors. Traders face the trade-off between average trading price and uncertainty, and traditional methods suffer...

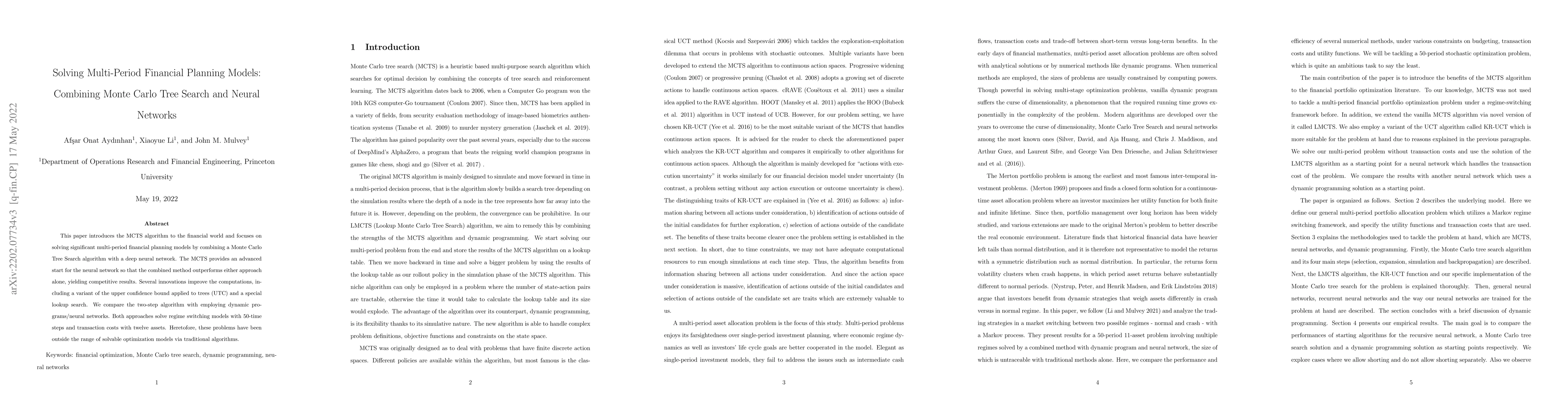

Solving Multi-Period Financial Planning Models: Combining Monte Carlo Tree Search and Neural Networks

This paper introduces the MCTS algorithm to the financial world and focuses on solving significant multi-period financial planning models by combining a Monte Carlo Tree Search algorithm with a deep...

Dynamic Factor Allocation Leveraging Regime-Switching Signals

This article explores dynamic factor allocation by analyzing the cyclical performance of factors through regime analysis. The authors focus on a U.S. equity investment universe comprising seven long-o...