Authors

Summary

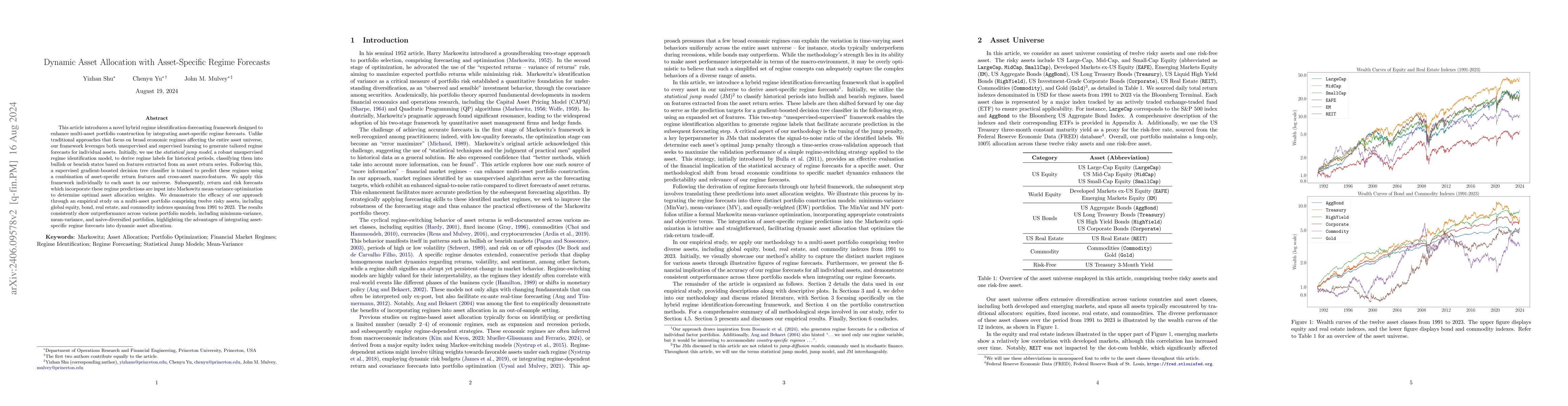

This article introduces a novel hybrid regime identification-forecasting framework designed to enhance multi-asset portfolio construction by integrating asset-specific regime forecasts. Unlike traditional approaches that focus on broad economic regimes affecting the entire asset universe, our framework leverages both unsunpervised and supervised learning to generate tailored regime forecasts for individual assets. Initially, we use the statistical jump model, a robust unsupervised regime identification model, to derive regime labels for historical periods, classifying them into bullish or bearish states based on features extracted from an asset return series. Following this, a supervised gradient-boosted decision tree classifier is trained to predict these regimes using a combination of asset-specific return features and cross-asset macro-features. We apply this framework individually to each asset in our universe. Subsequently, return and risk forecasts which incorporate these regime predictions are input into Markowitz mean-variance optimization to determine optimal asset allocation weights. We demonstrate the efficacy of our approach through an empirical study on a multi-asset portfolio comprising twelve risky assets, including global equity, bond, real estate, and commodity indexes spanning from 1991 to 2023. The results consistently show outperformance across various portfolio models, including minimum-variance, mean-variance, and naive-diversified portfolios, highlighting the advantages of integrating asset-specific regime forecasts into dynamic asset allocation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTactical Asset Allocation with Macroeconomic Regime Detection

Mihai Cucuringu, Xiaowen Dong, André Fujita et al.

A Dynamic Model of Private Asset Allocation

Hui Chen, Yu Xu, Simon Scheidegger et al.

Strategic Asset Allocation with Illiquid Alternatives

Stephen Boyd, Mykel Kochenderfer, Wen Cao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)