Summary

This article investigates the impact of regime switching on asset allocation decisions, with a primary focus on comparing different regime identification models. In contrast to traditional Markov-switching models, we adopt the statistical jump model, a recently proposed robust model known for its ability to capture persistent market regimes by applying an explicit jump penalty. The feature set of our jump model comprises return and volatility features derived solely from the price series. We introduce a data-driven approach for selecting the jump penalty within a time-series cross-validation framework, which directly optimizes the performance metric of the regime-aware asset allocation strategy constructed following a comprehensive multi-step process. Through empirical analysis using daily return series from major US equity indices, we highlight the outperformance of employing jump models in comparison to both buy-and-hold strategies and Markov-switching asset allocation approaches. These results underline the enhanced robustness, interpretability, and realism inherent in asset allocation strategies guided by jump models, offering insights for portfolio managers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

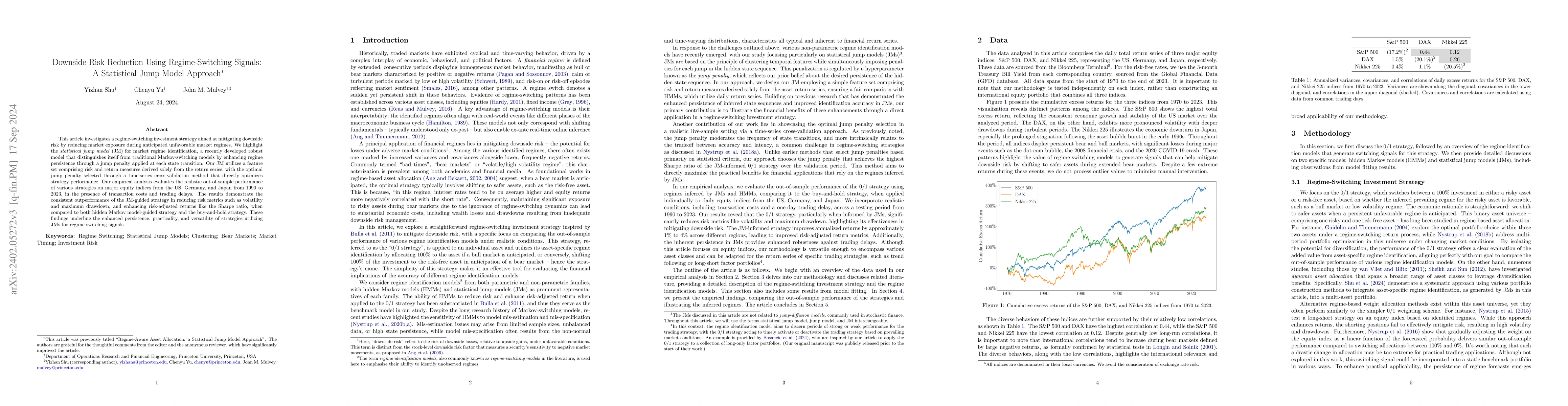

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Asset Allocation with Asset-Specific Regime Forecasts

John M. Mulvey, Yizhan Shu, Chenyu Yu

Tactical Asset Allocation with Macroeconomic Regime Detection

Mihai Cucuringu, Xiaowen Dong, André Fujita et al.

Statistical Learning for Individualized Asset Allocation

Yi Ding, Yingying Li, Rui Song

| Title | Authors | Year | Actions |

|---|

Comments (0)