Jonathan Yu-Meng Li

6 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Inverse Optimization of Convex Risk Functions

The theory of convex risk functions has now been well established as the basis for identifying the families of risk functions that should be used in risk averse optimization problems. Despite its th...

Wasserstein-Kelly Portfolios: A Robust Data-Driven Solution to Optimize Portfolio Growth

We introduce a robust variant of the Kelly portfolio optimization model, called the Wasserstein-Kelly portfolio optimization. Our model, taking a Wasserstein distributionally robust optimization (DR...

On Generalization and Regularization via Wasserstein Distributionally Robust Optimization

Wasserstein distributionally robust optimization (DRO) has found success in operations research and machine learning applications as a powerful means to obtain solutions with favourable out-of-sampl...

A General Wasserstein Framework for Data-driven Distributionally Robust Optimization: Tractability and Applications

Data-driven distributionally robust optimization is a recently emerging paradigm aimed at finding a solution that is driven by sample data but is protected against sampling errors. An increasingly p...

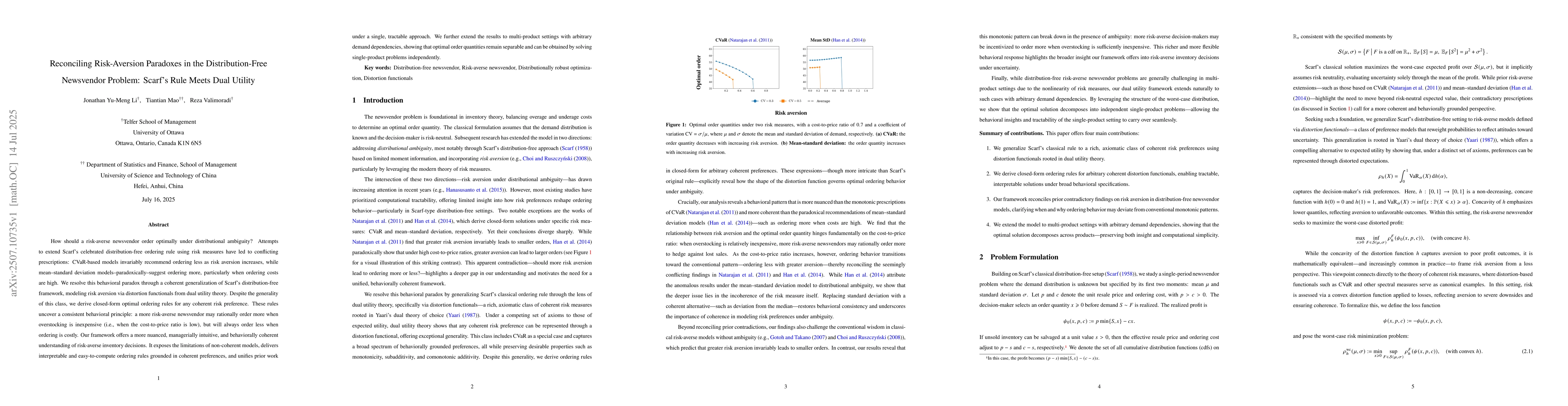

Reconciling Risk-Aversion Paradoxes in the Distribution-Free Newsvendor Problem: Scarf's Rule Meets Dual Utility

How should a risk-averse newsvendor order optimally under distributional ambiguity? Attempts to extend Scarf's celebrated distribution-free ordering rule using risk measures have led to conflicting pr...

Conditional Risk Minimization with Side Information: A Tractable, Universal Optimal Transport Framework

Conditional risk minimization arises in high-stakes decisions where risk must be assessed in light of side information, such as stressed economic conditions, specific customer profiles, or other conte...