Summary

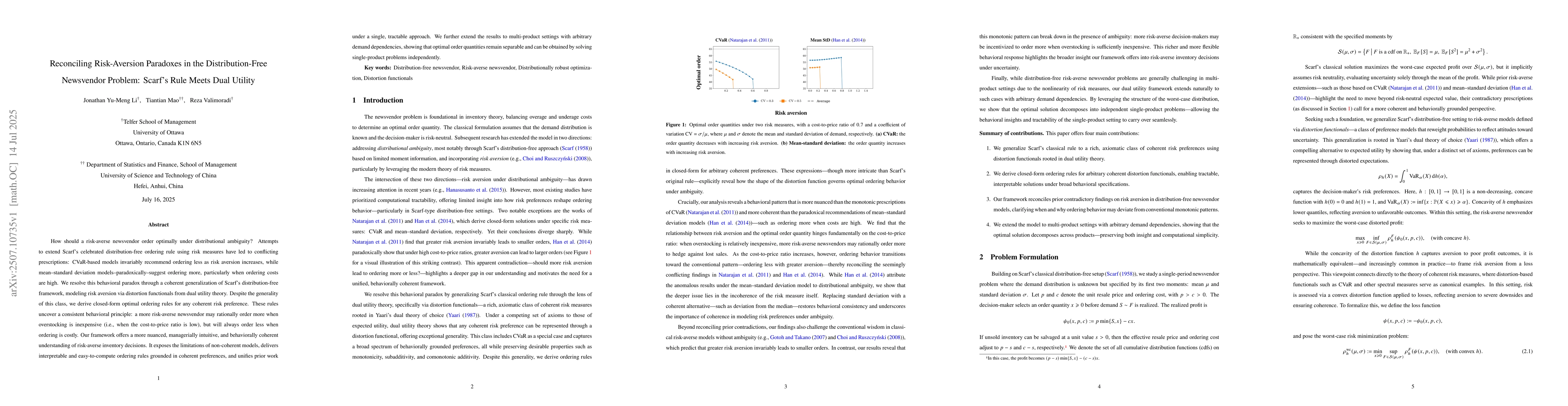

How should a risk-averse newsvendor order optimally under distributional ambiguity? Attempts to extend Scarf's celebrated distribution-free ordering rule using risk measures have led to conflicting prescriptions: CVaR-based models invariably recommend ordering less as risk aversion increases, while mean-standard deviation models -- paradoxically -- suggest ordering more, particularly when ordering costs are high. We resolve this behavioral paradox through a coherent generalization of Scarf's distribution-free framework, modeling risk aversion via distortion functionals from dual utility theory. Despite the generality of this class, we derive closed-form optimal ordering rules for any coherent risk preference. These rules uncover a consistent behavioral principle: a more risk-averse newsvendor may rationally order more when overstocking is inexpensive (i.e., when the cost-to-price ratio is low), but will always order less when ordering is costly. Our framework offers a more nuanced, managerially intuitive, and behaviorally coherent understanding of risk-averse inventory decisions. It exposes the limitations of non-coherent models, delivers interpretable and easy-to-compute ordering rules grounded in coherent preferences, and unifies prior work under a single, tractable approach. We further extend the results to multi-product settings with arbitrary demand dependencies, showing that optimal order quantities remain separable and can be obtained by solving single-product problems independently.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)