Lucio Fernandez-Arjona

2 papers on arXiv

Academic Profile

Statistics

arXiv Papers

2

Total Publications

4

Similar Authors

Papers on arXiv

A neural network model for solvency calculations in life insurance

Insurance companies make extensive use of Monte Carlo simulations in their capital and solvency models. To overcome the computational problems associated with Monte Carlo simulations, most large lif...

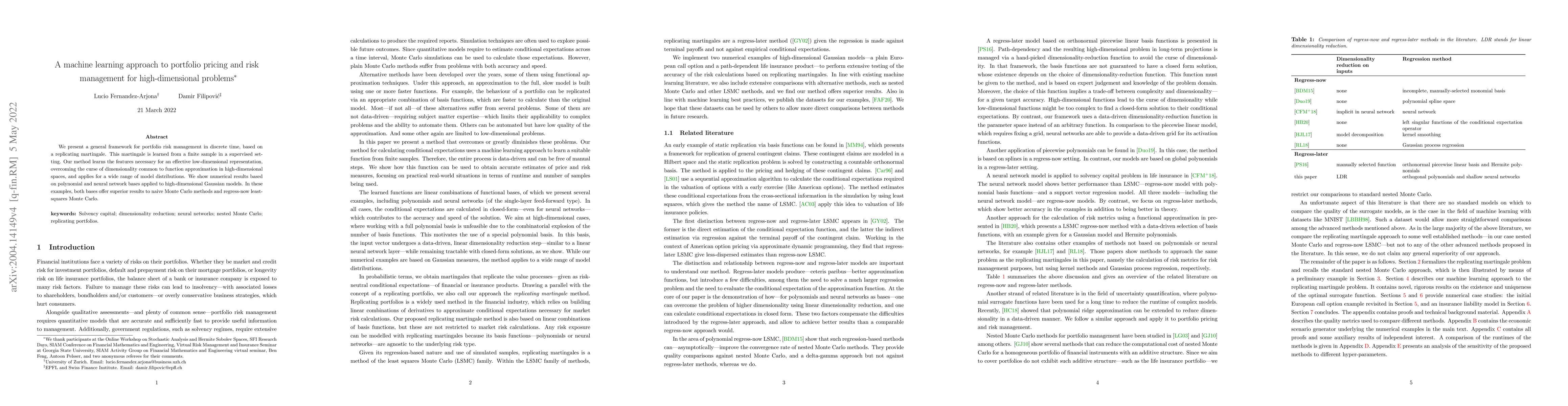

A machine learning approach to portfolio pricing and risk management for high-dimensional problems

We present a general framework for portfolio risk management in discrete time, based on a replicating martingale. This martingale is learned from a finite sample in a supervised setting. The model l...