Summary

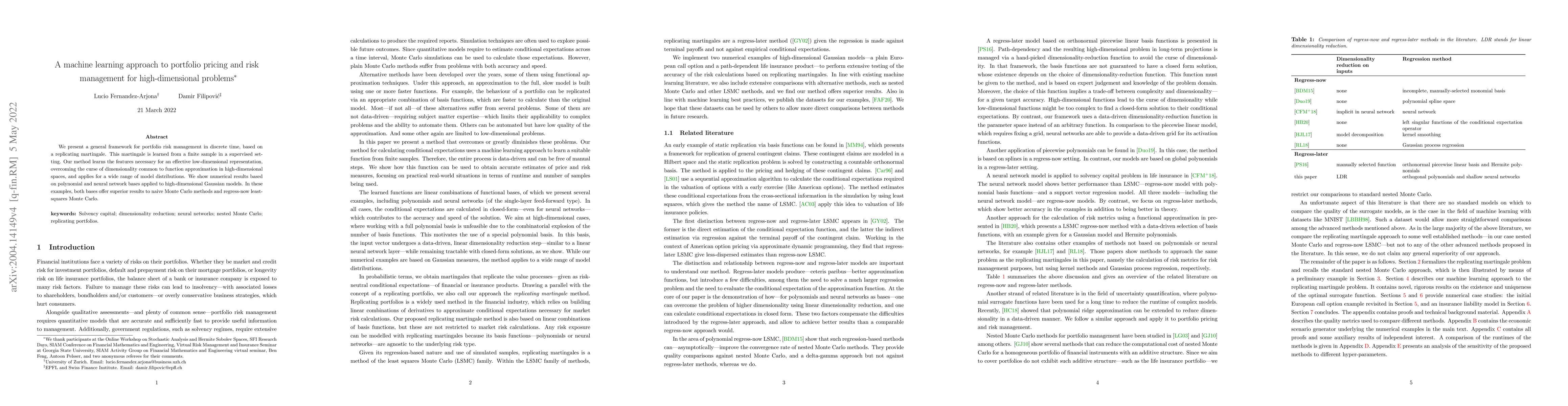

We present a general framework for portfolio risk management in discrete time, based on a replicating martingale. This martingale is learned from a finite sample in a supervised setting. The model learns the features necessary for an effective low-dimensional representation, overcoming the curse of dimensionality common to function approximation in high-dimensional spaces. We show results based on polynomial and neural network bases. Both offer superior results to naive Monte Carlo methods and other existing methods like least-squares Monte Carlo and replicating portfolios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnsemble learning for portfolio valuation and risk management

Damir Filipović, Lotfi Boudabsa

Leveraging Machine Learning for High-Dimensional Option Pricing within the Uncertain Volatility Model

Andrea Molent, Antonino Zanette, Ludovic Goudenege

| Title | Authors | Year | Actions |

|---|

Comments (0)