Authors

Summary

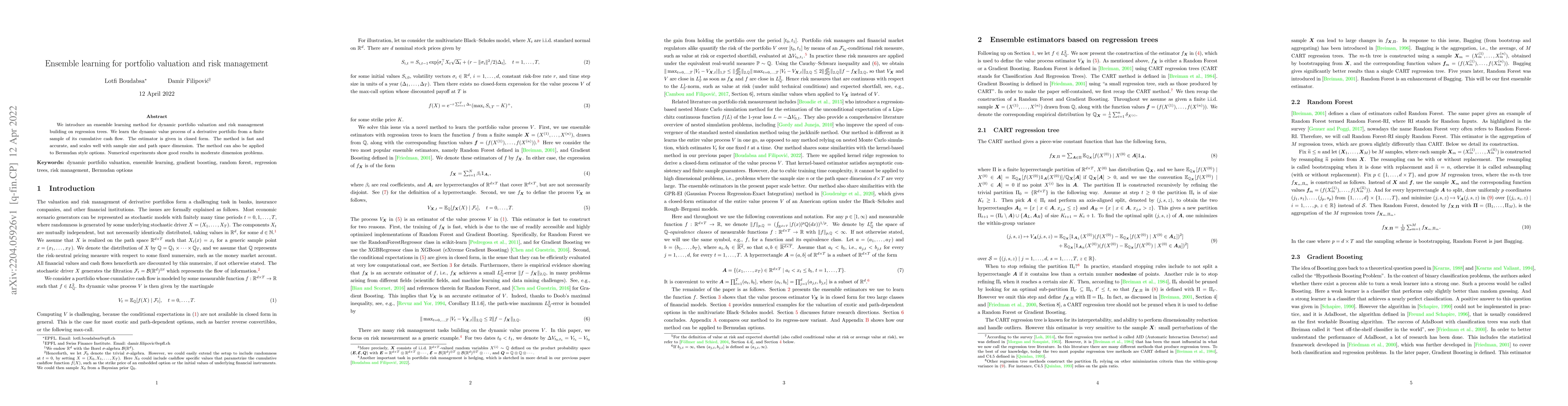

We introduce an ensemble learning method for dynamic portfolio valuation and risk management building on regression trees. We learn the dynamic value process of a derivative portfolio from a finite sample of its cumulative cash flow. The estimator is given in closed form. The method is fast and accurate, and scales well with sample size and path space dimension. The method can also be applied to Bermudan style options. Numerical experiments show good results in moderate dimension problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-Hypothesis Prediction for Portfolio Optimization: A Structured Ensemble Learning Approach to Risk Diversification

Xia Hong, Muhammad Shahzad, Alejandro Rodriguez Dominguez

Balancing Profit, Risk, and Sustainability for Portfolio Management

Charl Maree, Christian W. Omlin

No citations found for this paper.

Comments (0)