Authors

Summary

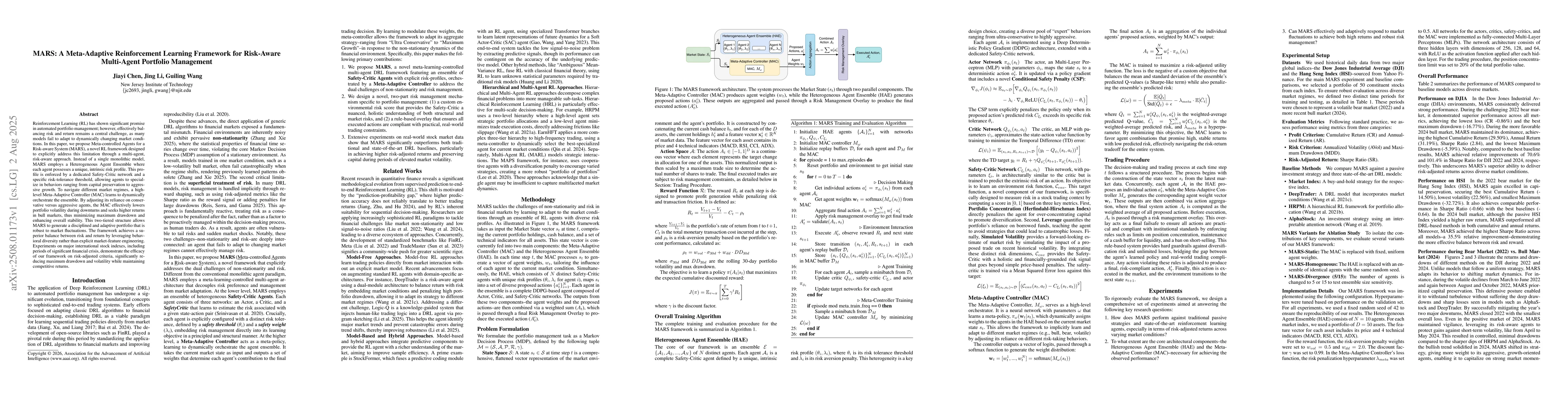

Reinforcement Learning (RL) has shown significant promise in automated portfolio management; however, effectively balancing risk and return remains a central challenge, as many models fail to adapt to dynamically changing market conditions. In this paper, we propose Meta-controlled Agents for a Risk-aware System (MARS), a novel RL framework designed to explicitly address this limitation through a multi-agent, risk-aware approach. Instead of a single monolithic model, MARS employs a Heterogeneous Agent Ensemble where each agent possesses a unique, intrinsic risk profile. This profile is enforced by a dedicated Safety-Critic network and a specific risk-tolerance threshold, allowing agents to specialize in behaviors ranging from capital preservation to aggressive growth. To navigate different market regimes, a high-level Meta-Adaptive Controller (MAC) learns to dynamically orchestrate the ensemble. By adjusting its reliance on conservative versus aggressive agents, the MAC effectively lowers portfolio volatility during downturns and seeks higher returns in bull markets, thus minimizing maximum drawdown and enhancing overall stability. This two-tiered structure allows MARS to generate a disciplined and adaptive portfolio that is robust to market fluctuations. The framework achieves a superior balance between risk and return by leveraging behavioral diversity rather than explicit market-feature engineering. Experiments on major international stock indexes, including periods of significant financial crisis, demonstrate the efficacy of our framework on risk-adjusted criteria, significantly reducing maximum drawdown and volatility while maintaining competitive returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDeveloping A Multi-Agent and Self-Adaptive Framework with Deep Reinforcement Learning for Dynamic Portfolio Risk Management

Zhenglong Li, Vincent Tam, Kwan L. Yeung

DeltaHedge: A Multi-Agent Framework for Portfolio Options Optimization

Jarosław A. Chudziak, Feliks Bańka

Comments (0)