Authors

Summary

In volatile financial markets, balancing risk and return remains a significant challenge. Traditional approaches often focus solely on equity allocation, overlooking the strategic advantages of options trading for dynamic risk hedging. This work presents DeltaHedge, a multi-agent framework that integrates options trading with AI-driven portfolio management. By combining advanced reinforcement learning techniques with an ensembled options-based hedging strategy, DeltaHedge enhances risk-adjusted returns and stabilizes portfolio performance across varying market conditions. Experimental results demonstrate that DeltaHedge outperforms traditional strategies and standalone models, underscoring its potential to transform practical portfolio management in complex financial environments. Building on these findings, this paper contributes to the fields of quantitative finance and AI-driven portfolio optimization by introducing a novel multi-agent system for integrating options trading strategies, addressing a gap in the existing literature.

AI Key Findings

Generated Sep 22, 2025

Methodology

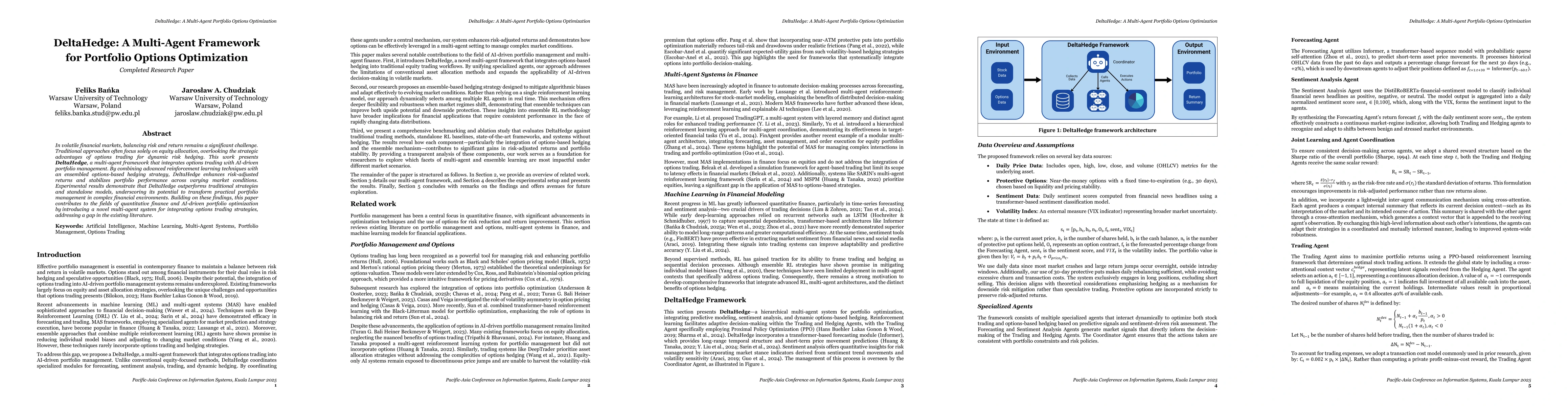

The research introduces DeltaHedge, a hierarchical multi-agent framework combining reinforcement learning with options trading. It employs specialized agents for forecasting, sentiment analysis, trading, and hedging, with an ensemble mechanism selecting optimal hedging policies. Data sources include stock prices, sentiment analysis, and options data, validated through empirical testing on S&P 500, Apple, and Tesla.

Key Results

- DeltaHedge achieves Sharpe ratios up to 1.33 and Sortino ratios up to 1.81, doubling risk-adjusted metrics compared to standard benchmarks.

- Drawdowns are reduced to one-third of those seen under buy-and-hold or pure RL methods, demonstrating enhanced downside protection.

- Ablation studies confirm that each hedging layer contributes to performance gains, with the full ensemble delivering optimal return-risk balance.

Significance

This research bridges theoretical models with practical portfolio management by integrating advanced reinforcement learning with proven options-based hedging. It provides a scalable framework for adaptive risk management in complex financial markets, enhancing both returns and protection against market downturns.

Technical Contribution

The paper advances multi-agent systems in finance by merging reinforcement learning with options-based hedging, creating an adaptive framework that dynamically selects optimal hedging policies through ensemble mechanisms.

Novelty

DeltaHedge introduces a hierarchical multi-agent architecture with specialized roles and real-time policy selection, distinguishing it from traditional single-agent approaches and offering more robust, coordinated financial decision-making.

Limitations

- The framework relies on historical data and may not fully account for extreme market events or black swan scenarios.

- Implementation complexity could pose challenges for real-time deployment in high-frequency trading environments.

Future Work

- Incorporate advanced mathematical strategies like collars and straddles to refine hedging precision.

- Extend the framework to multi-asset portfolios for sector-level allocation and cross-instrument hedging.

- Develop richer inter-agent interaction protocols such as structured debate for consensus-driven decision-making.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFactor-MCLS: Multi-agent learning system with reward factor matrix and multi-critic framework for dynamic portfolio optimization

Ruoyu Sun, Angelos Stefanidis, Jionglong Su et al.

A novel multi-agent dynamic portfolio optimization learning system based on hierarchical deep reinforcement learning

Ruoyu Sun, Angelos Stefanidis, Jionglong Su et al.

Comments (0)