Authors

Summary

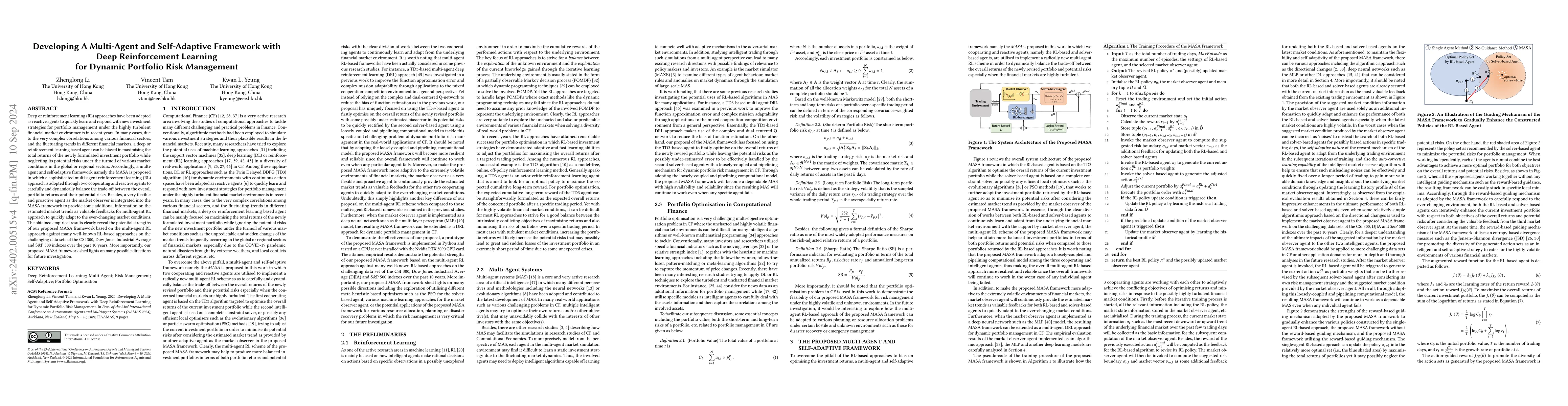

Deep or reinforcement learning (RL) approaches have been adapted as reactive agents to quickly learn and respond with new investment strategies for portfolio management under the highly turbulent financial market environments in recent years. In many cases, due to the very complex correlations among various financial sectors, and the fluctuating trends in different financial markets, a deep or reinforcement learning based agent can be biased in maximising the total returns of the newly formulated investment portfolio while neglecting its potential risks under the turmoil of various market conditions in the global or regional sectors. Accordingly, a multi-agent and self-adaptive framework namely the MASA is proposed in which a sophisticated multi-agent reinforcement learning (RL) approach is adopted through two cooperating and reactive agents to carefully and dynamically balance the trade-off between the overall portfolio returns and their potential risks. Besides, a very flexible and proactive agent as the market observer is integrated into the MASA framework to provide some additional information on the estimated market trends as valuable feedbacks for multi-agent RL approach to quickly adapt to the ever-changing market conditions. The obtained empirical results clearly reveal the potential strengths of our proposed MASA framework based on the multi-agent RL approach against many well-known RL-based approaches on the challenging data sets of the CSI 300, Dow Jones Industrial Average and S&P 500 indexes over the past 10 years. More importantly, our proposed MASA framework shed lights on many possible directions for future investigation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA novel multi-agent dynamic portfolio optimization learning system based on hierarchical deep reinforcement learning

Ruoyu Sun, Angelos Stefanidis, Jionglong Su et al.

MTS: A Deep Reinforcement Learning Portfolio Management Framework with Time-Awareness and Short-Selling

Ángel F. García-Fernández, Angelos Stefanidis, Jionglong Su et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)