Summary

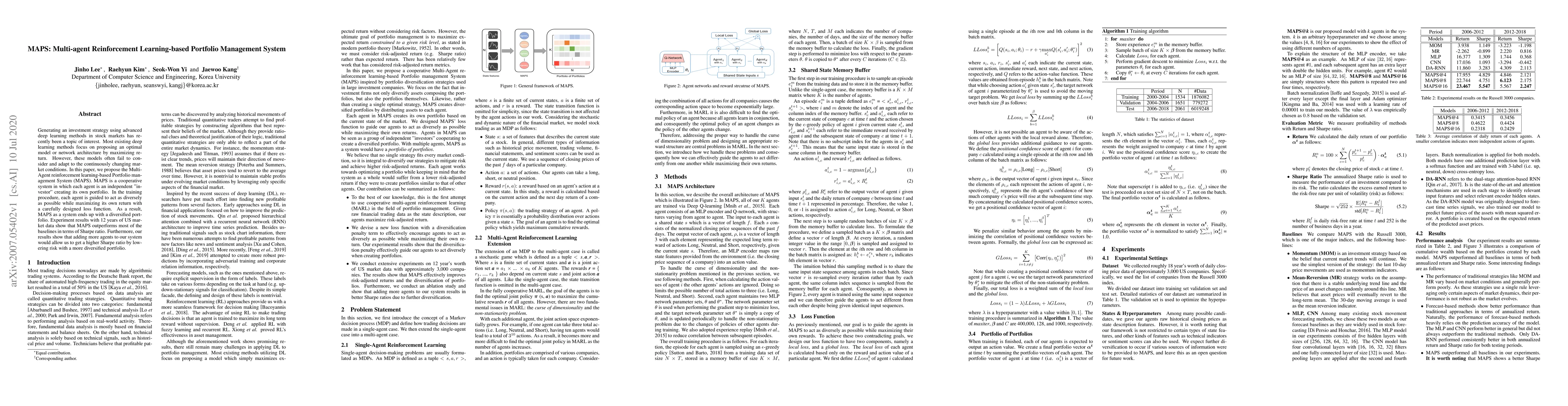

Generating an investment strategy using advanced deep learning methods in stock markets has recently been a topic of interest. Most existing deep learning methods focus on proposing an optimal model or network architecture by maximizing return. However, these models often fail to consider and adapt to the continuously changing market conditions. In this paper, we propose the Multi-Agent reinforcement learning-based Portfolio management System (MAPS). MAPS is a cooperative system in which each agent is an independent "investor" creating its own portfolio. In the training procedure, each agent is guided to act as diversely as possible while maximizing its own return with a carefully designed loss function. As a result, MAPS as a system ends up with a diversified portfolio. Experiment results with 12 years of US market data show that MAPS outperforms most of the baselines in terms of Sharpe ratio. Furthermore, our results show that adding more agents to our system would allow us to get a higher Sharpe ratio by lowering risk with a more diversified portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMSPM: A Modularized and Scalable Multi-Agent Reinforcement Learning-based System for Financial Portfolio Management

Zhenhan Huang, Fumihide Tanaka

A novel multi-agent dynamic portfolio optimization learning system based on hierarchical deep reinforcement learning

Ruoyu Sun, Angelos Stefanidis, Jionglong Su et al.

Developing A Multi-Agent and Self-Adaptive Framework with Deep Reinforcement Learning for Dynamic Portfolio Risk Management

Zhenglong Li, Vincent Tam, Kwan L. Yeung

CAD: Clustering And Deep Reinforcement Learning Based Multi-Period Portfolio Management Strategy

Jionglong Su, Zhengyong Jiang, Jeyan Thiayagalingam et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)