Authors

Summary

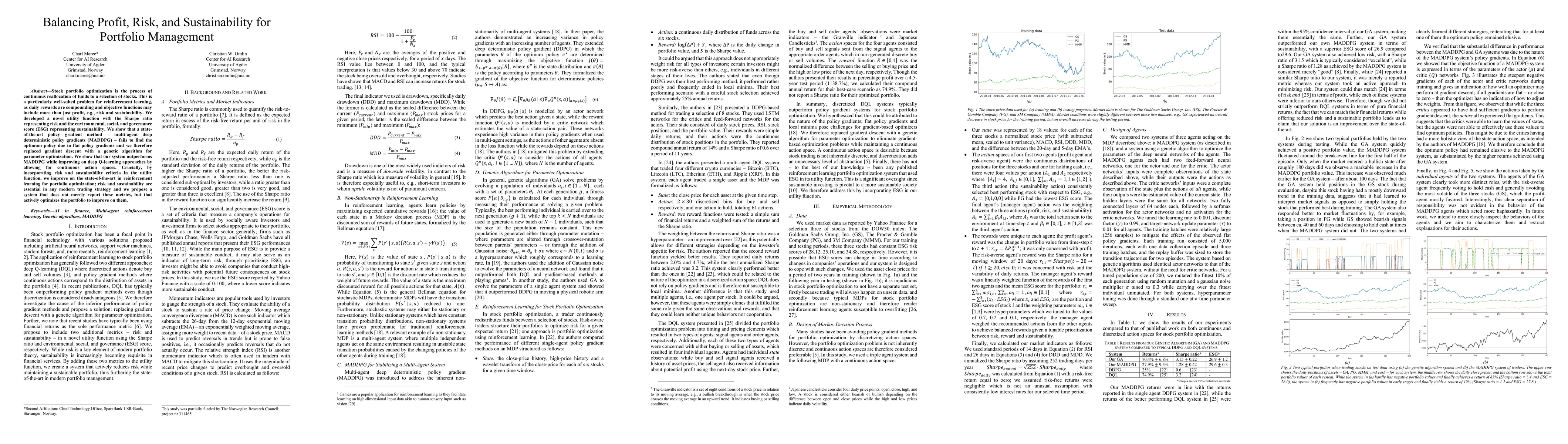

Stock portfolio optimization is the process of continuous reallocation of funds to a selection of stocks. This is a particularly well-suited problem for reinforcement learning, as daily rewards are compounding and objective functions may include more than just profit, e.g., risk and sustainability. We developed a novel utility function with the Sharpe ratio representing risk and the environmental, social, and governance score (ESG) representing sustainability. We show that a state-of-the-art policy gradient method - multi-agent deep deterministic policy gradients (MADDPG) - fails to find the optimum policy due to flat policy gradients and we therefore replaced gradient descent with a genetic algorithm for parameter optimization. We show that our system outperforms MADDPG while improving on deep Q-learning approaches by allowing for continuous action spaces. Crucially, by incorporating risk and sustainability criteria in the utility function, we improve on the state-of-the-art in reinforcement learning for portfolio optimization; risk and sustainability are essential in any modern trading strategy and we propose a system that does not merely report these metrics, but that actively optimizes the portfolio to improve on them.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnsemble learning for portfolio valuation and risk management

Damir Filipović, Lotfi Boudabsa

Implementing portfolio risk management and hedging in practice

Paul Alexander Bilokon

| Title | Authors | Year | Actions |

|---|

Comments (0)