Damir Filipović

7 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Neural Control Systems

We propose a function-learning methodology with a control-theoretical foundation. We parametrise the approximating function as the solution to a control system on a reproducing-kernel Hilbert space,...

Sparse Portfolio Selection via Topological Data Analysis based Clustering

This paper uses topological data analysis (TDA) tools and introduces a data-driven clustering-based stock selection strategy tailored for sparse portfolio construction. Our asset selection strategy ...

Empirical Asset Pricing via Ensemble Gaussian Process Regression

We introduce an ensemble learning method based on Gaussian Process Regression (GPR) for predicting conditional expected stock returns given stock-level and macro-economic information. Our ensemble l...

Ensemble learning for portfolio valuation and risk management

We introduce an ensemble learning method for dynamic portfolio valuation and risk management building on regression trees. We learn the dynamic value process of a derivative portfolio from a finite ...

Mean-Covariance Robust Risk Measurement

We introduce a universal framework for mean-covariance robust risk measurement and portfolio optimization. We model uncertainty in terms of the Gelbrich distance on the mean-covariance space, along ...

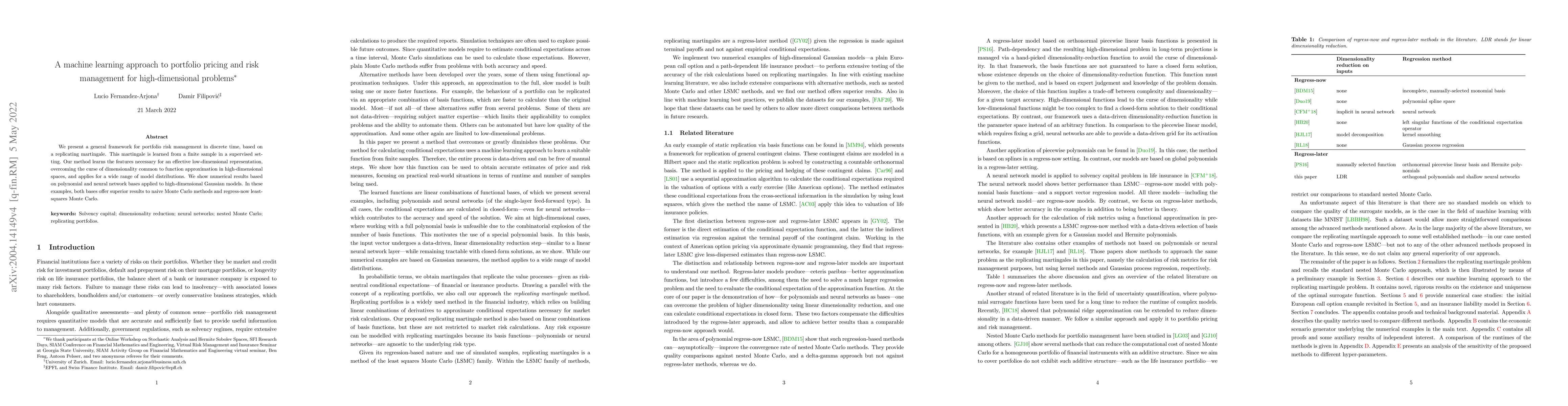

A machine learning approach to portfolio pricing and risk management for high-dimensional problems

We present a general framework for portfolio risk management in discrete time, based on a replicating martingale. This martingale is learned from a finite sample in a supervised setting. The model l...

Error Propagation in Dynamic Programming: From Stochastic Control to Option Pricing

This paper investigates theoretical and methodological foundations for stochastic optimal control (SOC) in discrete time. We start formulating the control problem in a general dynamic programming fram...