Summary

This paper uses topological data analysis (TDA) tools and introduces a data-driven clustering-based stock selection strategy tailored for sparse portfolio construction. Our asset selection strategy exploits the topological features of stock price movements to select a subset of topologically similar (different) assets for a sparse index tracking (Markowitz) portfolio. We introduce new distance measures, which serve as an input to the clustering algorithm, on the space of persistence diagrams and landscapes that consider the time component of a time series. We conduct an empirical analysis on the S\&P index from 2009 to 2020, including a study on the COVID-19 data to validate the robustness of our methodology. Our strategy to integrate TDA with the clustering algorithm significantly enhanced the performance of sparse portfolios across various performance measures in diverse market scenarios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

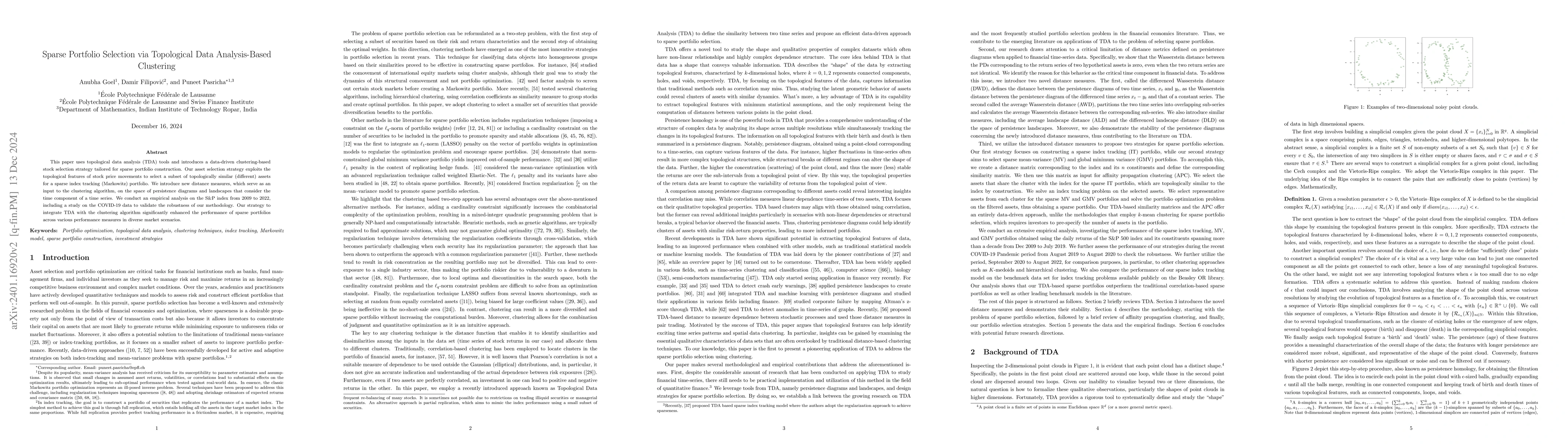

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortfolio Selection via Topological Data Analysis

Alexey Zaytsev, Kristian Kuznetsov, Petr Sokerin et al.

Sparse Portfolio selection via Bayesian Multiple testing

Sourish Das, Rituparna Sen

| Title | Authors | Year | Actions |

|---|

Comments (0)