Summary

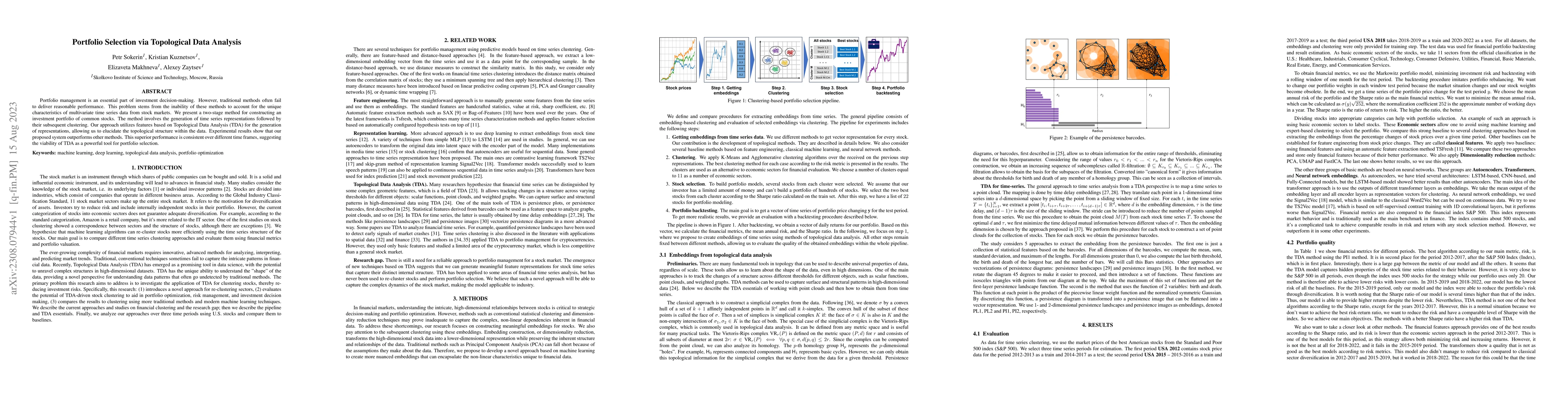

Portfolio management is an essential part of investment decision-making. However, traditional methods often fail to deliver reasonable performance. This problem stems from the inability of these methods to account for the unique characteristics of multivariate time series data from stock markets. We present a two-stage method for constructing an investment portfolio of common stocks. The method involves the generation of time series representations followed by their subsequent clustering. Our approach utilizes features based on Topological Data Analysis (TDA) for the generation of representations, allowing us to elucidate the topological structure within the data. Experimental results show that our proposed system outperforms other methods. This superior performance is consistent over different time frames, suggesting the viability of TDA as a powerful tool for portfolio selection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSparse Portfolio Selection via Topological Data Analysis based Clustering

Damir Filipović, Anubha Goel, Puneet Pasricha

Topological Portfolio Selection and Optimization

Antonio Briola, Tomaso Aste, Yuanrong Wang

Sparse Portfolio selection via Bayesian Multiple testing

Sourish Das, Rituparna Sen

No citations found for this paper.

Comments (0)