Michael Donisch

1 papers on arXiv

Academic Profile

Statistics

arXiv Papers

1

Total Publications

1

Similar Authors

Papers on arXiv

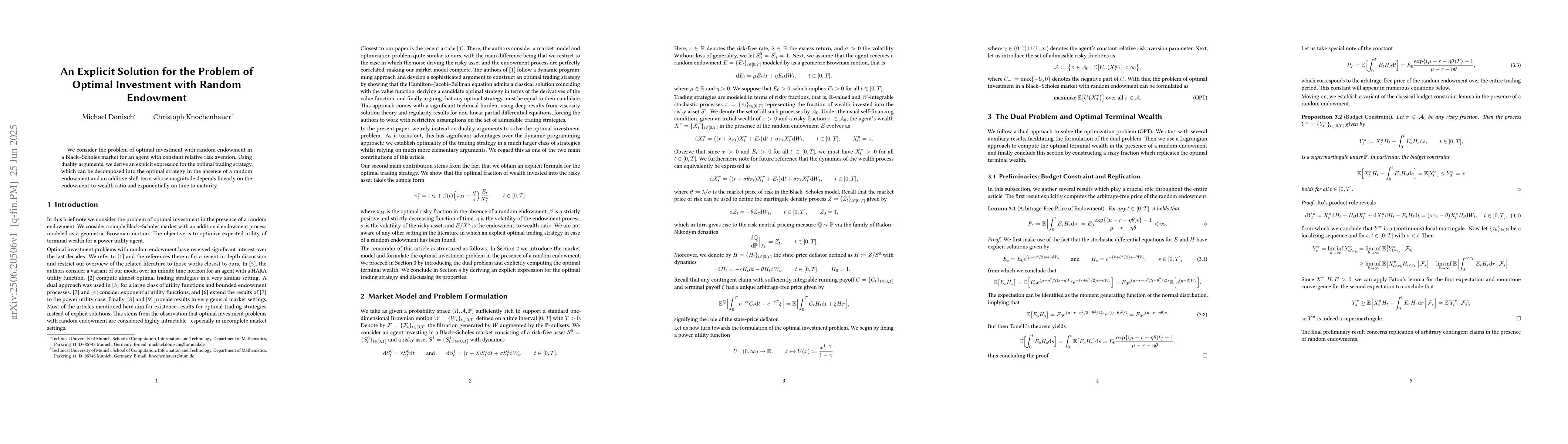

An Explicit Solution for the Problem of Optimal Investment with Random Endowment

We consider the problem of optimal investment with random endowment in a Black--Scholes market for an agent with constant relative risk aversion. Using duality arguments, we derive an explicit express...