Summary

We consider the problem of optimal investment with random endowment in a Black--Scholes market for an agent with constant relative risk aversion. Using duality arguments, we derive an explicit expression for the optimal trading strategy, which can be decomposed into the optimal strategy in the absence of a random endowment and an additive shift term whose magnitude depends linearly on the endowment-to-wealth ratio and exponentially on time to maturity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

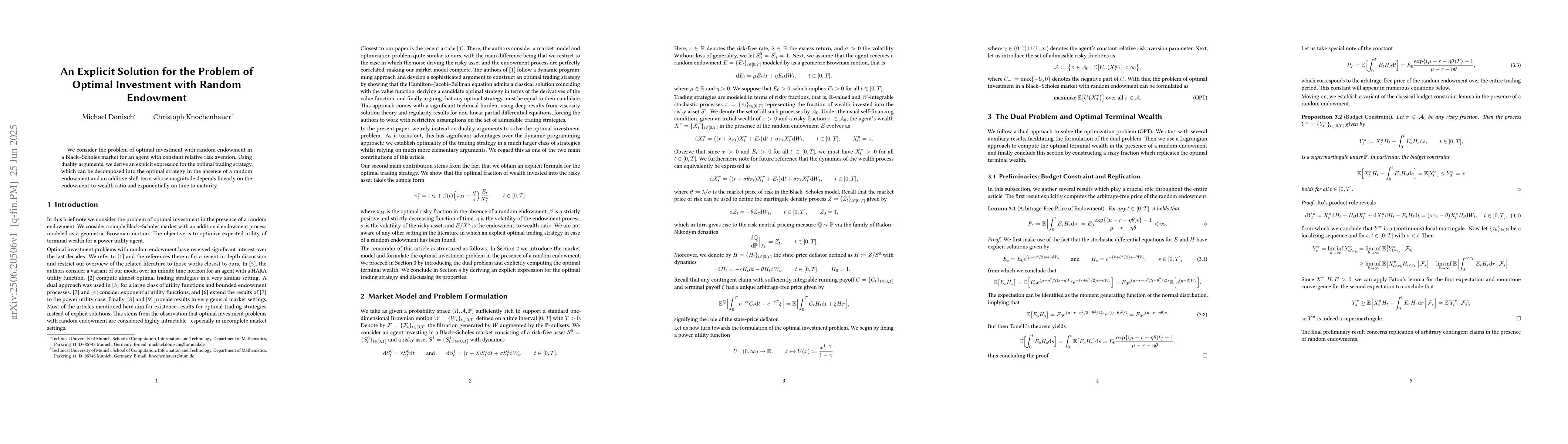

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)