Summary

In this paper, we consider a num\'eraire-based utility maximization problem under constant proportional transaction costs and random endowment. Assuming that the agent cannot short sell assets and is endowed with a strictly positive contingent claim, a primal optimizer of this utility maximization problem exists. Moreover, we observe that the original market with transaction costs can be replaced by a frictionless shadow market that yields the same optimality. On the other hand, we present an example to show that in some case when these constraints are relaxed, the existence of shadow prices is still warranted.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

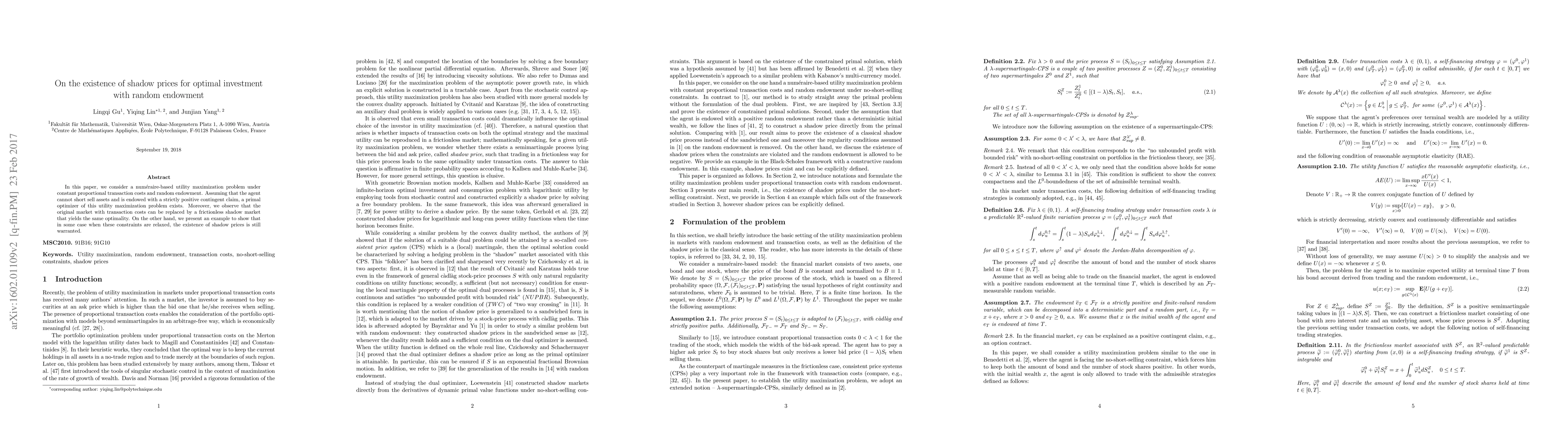

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Explicit Solution for the Problem of Optimal Investment with Random Endowment

Christoph Knochenhauer, Michael Donisch

| Title | Authors | Year | Actions |

|---|

Comments (0)