Minh-Ngoc Tran

14 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Semi-parametric financial risk forecasting incorporating multiple realized measures

A semi-parametric joint Value-at-Risk (VaR) and Expected Shortfall (ES) forecasting framework employing multiple realized measures is developed. The proposed framework extends the realized exponenti...

Data Scaling Effect of Deep Learning in Financial Time Series Forecasting

For years, researchers investigated the applications of deep learning in forecasting financial time series. However, they continued to rely on the conventional econometric approach for model trainin...

Wasserstein Gaussianization and Efficient Variational Bayes for Robust Bayesian Synthetic Likelihood

The Bayesian Synthetic Likelihood (BSL) method is a widely-used tool for likelihood-free Bayesian inference. This method assumes that some summary statistics are normally distributed, which can be i...

Particle Mean Field Variational Bayes

The Mean Field Variational Bayes (MFVB) method is one of the most computationally efficient techniques for Bayesian inference. However, its use has been restricted to models with conjugate priors or...

Bayesian Inference for Evidence Accumulation Models with Regressors

Evidence accumulation models (EAMs) are an important class of cognitive models used to analyze both response time and response choice data recorded from decision-making tasks. Developments in estima...

Deep Learning Enhanced Realized GARCH

We propose a new approach to volatility modeling by combining deep learning (LSTM) and realized volatility measures. This LSTM-enhanced realized GARCH framework incorporates and distills modeling ad...

An Introduction to Quantum Computing for Statisticians and Data Scientists

Quantum computers promise to surpass the most powerful classical supercomputers when it comes to solving many critically important practical problems, such as pharmaceutical and fertilizer design, s...

Quantum Speedup of Natural Gradient for Variational Bayes

Variational Bayes (VB) is a critical method in machine learning and statistics, underpinning the recent success of Bayesian deep learning. The natural gradient is an essential component of efficient...

Time-evolving psychological processes over repeated decisions

Many psychological experiments have subjects repeat a task to gain the statistical precision required to test quantitative theories of psychological performance. In such experiments, time-on-task ca...

A Statistical Recurrent Stochastic Volatility Model for Stock Markets

The Stochastic Volatility (SV) model and its variants are widely used in the financial sector while recurrent neural network (RNN) models are successfully used in many large-scale industrial applica...

Loss-based Bayesian Sequential Prediction of Value at Risk with a Long-Memory and Non-linear Realized Volatility Model

A long memory and non-linear realized volatility model class is proposed for direct Value at Risk (VaR) forecasting. This model, referred to as RNN-HAR, extends the heterogeneous autoregressive (HAR) ...

Deep Learning Enhanced Multivariate GARCH

This paper introduces a novel multivariate volatility modeling framework, named Long Short-Term Memory enhanced BEKK (LSTM-BEKK), that integrates deep learning into multivariate GARCH processes. By co...

PREIG: Physics-informed and Reinforcement-driven Interpretable GRU for Commodity Demand Forecasting

Accurately forecasting commodity demand remains a critical challenge due to volatile market dynamics, nonlinear dependencies, and the need for economically consistent predictions. This paper introduce...

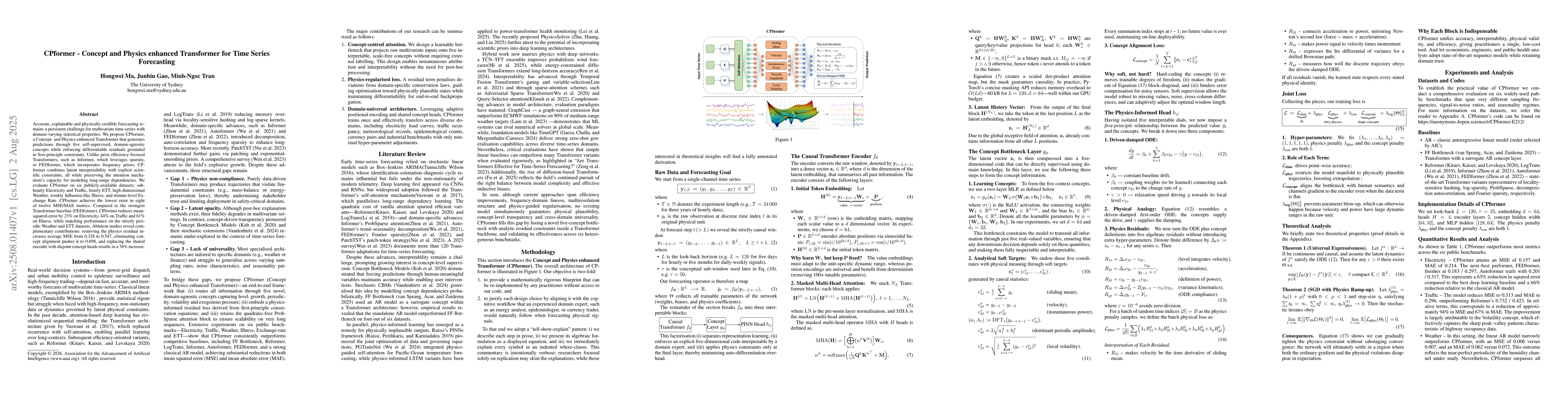

CPformer -- Concept and Physics enhanced Transformer for Time Series Forecasting

Accurate, explainable and physically-credible forecasting remains a persistent challenge for multivariate time-series whose statistical properties vary across domains. We present CPformer, a Concept- ...